See feature articles below:

About Broad Street Alerts:

Big opportunities in Small Cap’s

Broad Street Alerts recent profiles and track record, 153% in verifiable potential gains for our members on the last 3 small cap alerts alone!

February 10th, 2016- (NASDAQ: BONT) opened $1.65/share hit a high of $3.00/share within 30 days our member potential gains- 83%

March 7th, 2016-(NYSE-MKT: FSI) opened at .91/share and hit 1.10/share within 5 days for gains of 21% for our members.

March 24th, 2016- (NASDAQ: ICLD) opened at $.77/share it a high of $1.15/share within 2 days for gains of 49% for our members.

These are numbers that make traders drool. Any trader in any market would fall all over themselves to see numbers like this. So if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP SMS/text alert service for free, simply text the word “Alerts” to the phone number 25827 from your cell phone.

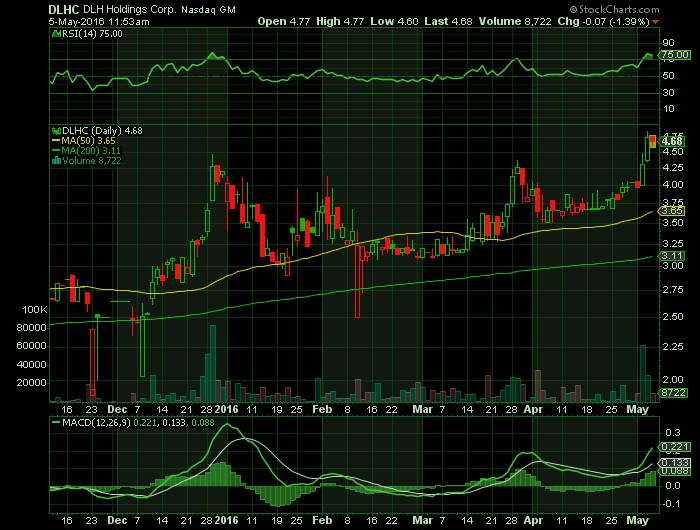

Report for: DLHC

Highly Strategic Combination Creates Unique Provider of Technology-Enabled Solutions to the Federal Government

Financially Transformative and Expected to be Immediately Accretive to Earnings and Cash Flow

Pro Forma for the Acquisition, Calendar Year 2015 Revenue and Adjusted EBITDA of Over $100 Million and $10 Million, Respectively, and Total Backlog in Excess of $300 Million

Purchase Price of $38.75 Million: $36.25 Million Cash, $2.5 Million Restricted Stock

Management to Host Conference Call at 2:00PM ET

Atlanta, Georgia – May 3, 2016 – DLH Holdings Corp. (DLHC) and Danya International (“Danya”) today announced that DLH has acquired privately held Danya, a leading provider of technology-enabled program management, consulting, and digital communications solutions, in a $38.75 million transaction, subject to customary adjustments, consisting of $36.25 million of cash and $2.5 million of restricted common stock. Danya will operate as a second wholly owned subsidiary of DLH Holdings Corp. Danya`s founder Jeff Hoffman will be retained as a Strategic Market Advisor to DLH for a period of up to two years.

“We view the addition of Danya as transformative for DLH as it significantly enhances our capabilities and enables us to achieve multiple objectives of our growth plan,” said DLH President & CEO, Zachary Parker. “The combination of these two companies creates a nationally recognized provider of technology-enabled solutions to the Federal Government. Their capabilities include managing, monitoring, and supporting large-scale healthcare and human services programs across the continuum of care and case management. From a strategic standpoint, this acquisition supports our growth strategy which calls for the expansion and diversification of our contract portfolio through both organic growth and acquisitions. This transaction combines two highly complementary businesses with common core capabilities. Further, Danya`s technological capabilities have immediate applications within DLH`s current and future engagements, and support our expansive organic growth opportunities.”

Dr. Jeff Hoffman, Danya`s CEO and principal shareholder stated “DLH is the ideal partner to continue to support and enhance Danya`s customers and capabilities, as well as the strategy and vision that I have spent the past 20 years developing and nurturing. The shared values and aligned interests of our organizations make this combination beneficial for our customers and employees. I look forward to working with Zach Parker and his team and seeing Danya continue to flourish as a part of DLH.”

Mr. Parker further stated, “Together, the two companies are not only better positioned to execute on their respective programs and missions, but are also able to leverage the combined capabilities of the `new` DLH to target larger opportunities that would have previously been unavailable to either company standalone. Danya`s federal IT management services experience will accelerate our health IT initiatives. We are extremely excited about the future opportunities that are created with this transaction.”

Overview of Danya International

Founded in 1996 and headquartered in Silver Spring, Maryland, Danya provides technology-enabled program management, public health expertise, consulting, and digital communications solutions primarily supporting federal health and education programs primarily within the Department of Health and Human Services (“HHS”). Since 1999, Danya has supported HHS`s Office of Head Start (“OHS”) under its flagship prime contract for the monitoring and evaluation of grants made under the Head Start program. Within HHS, Danya also serves the Centers for Disease Control and Prevention (“CDC”), as well as the U.S. Navy and the Department of Homeland Security. Danya currently employs approximately 150 full-time employees.

Strategic Benefits of the Transaction

Expands Business in Current and Adjacent Federal Agencies: Danya`s customers and capabilities are highly complementary to DLH`s existing work with the Department of Veterans Affairs (“VA”). The combined entity is a pure-play, technology-enabled government healthcare and human services company with a customer base including four of the largest government health agencies.

Enhances DLH`s Growth in National Priority, Mission-Critical Programs: DLH`s flagship contracts supporting all seven of VA`s Consolidated Mail Outpatient Pharmacy locations are mission-critical, ensuring that our nation`s veterans receive prescriptions in a timely and accurate manner. Similarly, Danya`s monitoring and evaluation services to OHS are critical to ensure educational, health, and social standards are being achieved in an effort to ensure school readiness for underprivileged children. Danya complements DLH`s services with significant operational synergies that we expect will serve the existing customer base along with expanding the base to additional government agencies.

Accelerates DLH`s Strategic Initiatives: Danya`s public health expertise with the CDC and the U.S. Navy enhances DLH`s advancement in key areas:

Medication adherence and medication therapy management solutions;

Telehealth research and service offerings to the Department of Defense and federal civilian agencies;

Health IT and information systems solutions and services; and

Case management system solutions and services.

Additive to Revenue Visibility and Accretive to Margins: With over $300 million of total backlog, which includes funded and unfunded amounts, the combined company maintains significant revenue visibility. Moreover, Danya`s margin profile is expected to be accretive to DLH in the current fiscal year.

Enhanced Free Cash Flow Profile: DLH believes that the combined company expects to maintain a strong free cash flow generation profile driven by enhanced profitability and limited working capital intensity, and augmented by DLH`s deferred tax assets from utilization of net operating losses. DLH expects to be able to shield substantially all cash payments of federal income taxes in the initial years following the acquisition. DLH believes that these factors will provide the ability to accelerate debt repayment.

Transaction Details

Purchase Price of $38.75 Million: Consisting of $36.25 million in cash and approximately $2.5 million of restricted common stock, subject to customary post-closing adjustments.

New Senior Debt of $30 Million Funded at Closing: DLH has entered into a new loan agreement with Fifth Third Bank providing for a $25 million term loan and $10 million revolving line of credit, of which $5 million is drawn as of the closing. The term loan and line of credit bear interest at a rate of LIBOR plus a margin of 300 basis points.

Restricted Common Stock Issued to Former Owner: DLH has issued 670,242 restricted shares of its common stock to the primary shareholder of Danya, valued at $2.5 million, or $3.73 per share, based on the volume weighted average price for the past 20 trading days.

Bridge Financing of $2.5 Million: Affiliates of Wynnefield Capital, the largest shareholder of DLH, have provided $2.5 million in a subordinated bridge loan. The Wynnefield bridge loan will accrue interest at an annual rate of 4%. DLH also issued the Wynnefield entities warrants with an exercise price of $3.73 covering 8% of the face value of the loan. It is the intention of DLH to repay the bridge loan with the proceeds of a rights offering so that all existing shareholders of DLH will have the opportunity to participate in the equity financing of the transaction. It is anticipated that Wynnefield will act as a standby purchaser of the rights offering to the extent of $2.5 million. The exercise price of the rights will be fixed at the time of the offering and will be subject to market conditions.

DLH will also use a portion of its existing cash balance to finance the remainder of the purchase price and transaction related expenses.

Source – Company Press Release

Broad street alerts has not been compensated for the mention of any publicly traded companies in this article nor do we own positions in any of the companies in this article.

Stock market

Hot small cap stocks

small cap stock picks

Biotech stocks

FDA approval stocks

FDA calendar

Trade stocks

Become a day trader

Day trade stocks for a living

PDUFA date set

micro cap stocks

Best stocks 2016

Hottest small cap stocks

Best stock picks

Who to follow for stock picks

Apple news stock picks

Stock picks on apple news