See feature articles below: (NYSE: ACW)

About Broad Street Alerts:

Big opportunities in Small Cap’s

Broad Street Alerts recent profiles and track record, 217% in verifiable potential gains for our members on the last 4 small cap alerts alone!

February 10th, 2016- (NASDAQ: BONT) opened $1.65/share hit a high of $3.00/share within 30 days our member potential gains- 83%

March 7th, 2016-(NYSE-MKT: FSI) opened at .91/share and hit 1.10/share within 5 days for gains of 21% for our members.

March 24th, 2016- (NASDAQ: ICLD) opened at $.77/share it a high of $1.15/share within 2 days for gains of 49% for our members.

These are numbers that make traders drool. Any trader in any market would fall all over themselves to see numbers like this. So if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP SMS/text alert service for free, simply text the word “Alerts” to the phone number 25827 from your cell phone.

Report on : (NYSE: ACW)

Accuride Co. (NYSE:ACW) major shareholder Coliseum Capital Management, L acquired 497,018 shares of the stock in a transaction dated Thursday, May 5th. The stock was acquired at an average cost of $1.59 per share, with a total value of $790,258.62. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Major shareholders that own 10% or more of a company’s stock are required to disclose their transactions with the SEC.

A hedge fund recently raised its stake in Accuride stock. Russell Frank Co raised its position in shares of Accuride Co. (NYSE:ACW) by 25.2% during the fourth quarter, Holdings Channel reports. The firm owned 758,270 shares of the company’s stock after buying an additional 152,417 shares during the period. Russell Frank Co owned 1.58% of Accuride worth $1,297,000 at the end of the most recent reporting period.

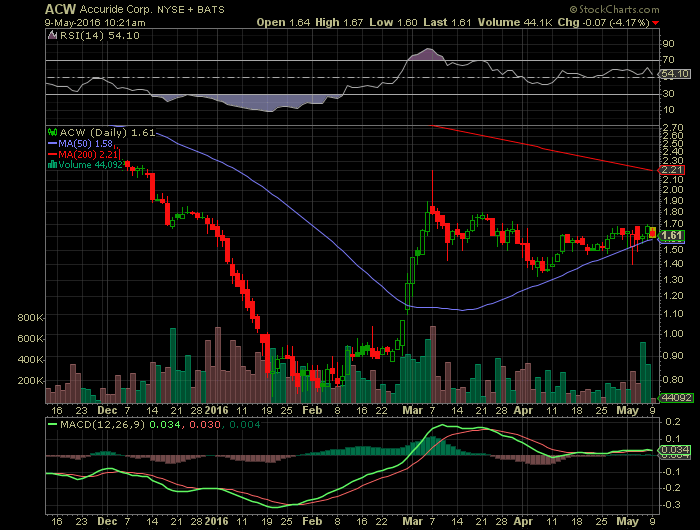

Accuride Co. (NYSE:ACW) opened at 1.68 on Monday. The firm’s market cap is $80.67 million. Accuride Co. has a 1-year low of $0.74 and a 1-year high of $4.67. The firm’s 50-day moving average price is $1.57 and its 200-day moving average price is $1.70.

Accuride (NYSE:ACW) last issued its earnings results on Tuesday, May 3rd. The company reported ($0.10) EPS for the quarter, missing the Zacks’ consensus estimate of ($0.04) by $0.06. The firm had revenue of $160.90 million for the quarter, compared to analyst estimates of $166.09 million. The firm’s revenue was down 12.4% on a year-over-year basis. During the same period last year, the business earned ($0.01) EPS. Equities research analysts anticipate that Accuride Co. will post ($0.17) earnings per share for the current fiscal year.

Several research analysts have recently weighed in on ACW shares. Gabelli lowered Accuride from a “buy” rating to a “hold” rating in a research report on Friday, January 22nd. Zacks Investment Research raised Accuride from a “sell” rating to a “hold” rating in a research report on Wednesday, January 27th. Finally, B. Riley reaffirmed a “neutral” rating and issued a $1.90 target price on shares of Accuride in a research report on Thursday.

Accuride Corporation is a manufacturer and supplier of commercial vehicle components in North America. The Company’s products include commercial vehicle wheels, wheel-end components and assemblies, and ductile and gray iron castings. The Company’s segments include Wheels, Gunite and Brillion Iron Works.

Source: Newsway 21 & ACAD Charts

Broad street alerts has not been compensated for the mention of any publicly traded companies in this article nor do we own positions in any of the companies in this article.