See Full Report below….

About Broad Street Alerts:

Big opportunities in Small Cap’s

Broad Street Alerts recent profiles and track record, 153% in verifiable potential gains for our

members in the last 3 small cap alerts alone!

- February 10th, 2016- (NASDAQ: BONT) opened $1.65/share hit a high of $3.00/share within 30 days our members gains- 83%

- March 7th, 2016-(NYSE-MKT: FSI) opened at .91/share and hit 1.10/share within 5 days for gains of 21% for our members.

- March 24th, 2016- (NASDAQ: ICLD) opened at $.77/share it a high of $1.15/share within 2 days for gains of 49% for our members.

These are numbers that make traders drool. Any trader in any market would fall all over themselves to

see numbers like this. So if you’ve been on the fence, perhaps it’s time to start doing some research and

verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest

of the small-cap newsletters as the best in business. We know with a large following comes a large

responsibility as we have everyone from institutional investors to the beginner following our profiled

securities in our newsletters. This is something we take very seriously always seeking small cap growth

companies that have both near and long-term potential for our members.

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our

VIP SMS/text alert service for free, simply text the word “Alerts” to the phone number 25827 from your cell phone.

Aeropostale Inc (NYSE:ARO)

Recently analysts working for a variety of stock market brokerages have changed their consensus ratings and price targets on shares of Aeropostale Inc (NYSE:ARO).

The most recent broker reports which have been released note that 0 analysts have a rating of “buy”, 0 analysts “outperform”, 8 analysts “hold”, 0 analysts “underperform” and 1 analysts “sell”.

Recent analyst ratings and price targets:

03/18/2016 – Aeropostale Inc had its “neutral” rating reiterated by analysts at Mizuho. They now have a USD 0.3 price target on the stock.

01/29/2016 – Aeropostale Inc had its “hold” rating reiterated by analysts at Stifel Nicolaus.

01/13/2016 – Aeropostale Inc had its “neutral” rating reiterated by analysts at SunTrust. They now have a USD 0.25 price target on the stock.

12/03/2015 – Aeropostale Inc had its “hold” rating reiterated by analysts at Topeka Capital Markets. They now have a USD 0.65 price target on the stock.

12/03/2015 – Aeropostale Inc had its “hold” rating reiterated by analysts at Jefferies. They now have a USD 0.6 price target on the stock.

12/03/2015 – Aeropostale Inc had its “underperform” rating reiterated by analysts at Telsey Advisory Group. They now have a USD 1 price target on the stock.

10/19/2015 – Aeropostale Inc had its “hold” rating reiterated by analysts at Wunderlich. They now have a USD 0.5 price target on the stock.

09/28/2015 – Aeropostale Inc had its “sell” rating reiterated by analysts at UBS. They now have a USD 0.5 price target on the stock.

08/28/2015 – Aeropostale Inc had its “underweight” rating reiterated by analysts at Morgan Stanley.

08/17/2015 – Wolfe Research began new coverage on Aeropostale Inc giving the company a “peer perform” rating. They now have a USD 2 price target on the stock.

05/26/2015 – Aeropostale Inc had its “neutral” rating reiterated by analysts at Janney Montgomery Scott. They now have a USD 2 price target on the stock.

05/22/2015 – Aeropostale Inc had its “equal weight” rating reiterated by analysts at Stephens. They now have a USD 3 price target on the stock.

05/22/2015 – Aeropostale Inc had its “market perform” rating reiterated by analysts at BMO Capital Markets. They now have a USD 2.5 price target on the stock.

05/22/2015 – Aeropostale Inc had its “positive” rating reiterated by analysts at Susquehanna. They now have a USD 5 price target on the stock.

05/22/2015 – Aeropostale Inc had its “market perform” rating reiterated by analysts at FBR Capital Markets. They now have a USD 3 price target on the stock.

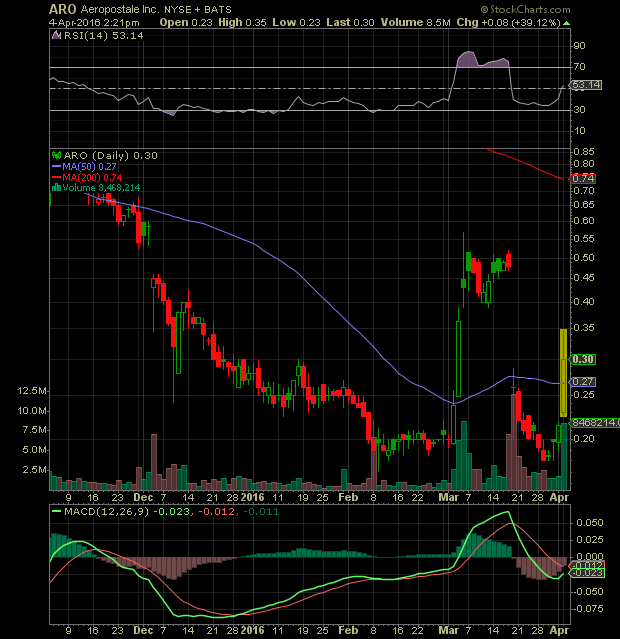

Aeropostale Inc has a 50 day moving average of 0.28 and a 200 day moving average of 0.44. The stock’s market capitalization is 14.41M, it has a 52-week low of 0.16 and a 52-week high of 3.64.

The share price of the company (NYSE:ARO) was down -6.20%, with a high of 0.20 during the day and the volume of Aeropostale Inc shares traded was 2448994.

Aeropostale, Inc. is a mall-based, specialty retailer of casual apparel and accessories. The Company operates through two segments: retail stores and e-commerce, and international licensing. It is principally focused on 14 to 17 year-old young women and men through its Aeropostale stores and 4 to 12 year-olds through its P.S. from Aeropostale stores. As of January 31, 2015, it operated 860 stores, consisting of 773 Aeropostale stores in all 50 states and Puerto Rico, 61 Aeropostale stores in Canada, as well as 26 P.S. from Aeropostale stores in 12 states. In addition, pursuant to various licensing agreements, its licensees operated 239 Aeropostale and P.S. from Aeropostale locations in the Middle East, Asia, Europe and Latin America as of January 31, 2015. It also operates GoJane.com, an online women’s fashion footwear and apparel retailer.

Barchart opinion

| Composite Indicators | Signal | ||||||||||

| Sell | |||||||||||

| Short Term Indicators | |||||||||||

| Buy | |||||||||||

| Buy | |||||||||||

| Sell | |||||||||||

| Buy | |||||||||||

| Hold | |||||||||||

| Short Term Indicators Average: 40% Buy | |||||||||||

| 20-Day Average Volume – 3,286,828 | |||||||||||

| Medium Term Indicators | |||||||||||

| Hold | |||||||||||

| Buy | |||||||||||

| Sell | |||||||||||

| Sell | |||||||||||

| Medium Term Indicators Average: 25% Sell | |||||||||||

| 50-Day Average Volume – 2,198,439 | |||||||||||

| Long Term Indicators | |||||||||||

| Hold | |||||||||||

| Sell | |||||||||||

| Sell | |||||||||||

| Long Term Indicators Average: 67% Sell | |||||||||||

| 100-Day Average Volume – 1,775,700 | |||||||||||

| Overall Average: 16% Sell | |||||||||||

|

|||||||||||

Sources- Sharetrading.news.com, yahoo finance , Broad Street Alerts, stockscharts.com, Barchart.com

Broad Street Alerts has not been compensated for the mention of ARO and we do not hold any positions.