| Composite Indicators | Signal | ||||||||||

| Buy | |||||||||||

| Short Term Indicators | |||||||||||

| Buy | |||||||||||

| Buy | |||||||||||

| Buy | |||||||||||

| Buy | |||||||||||

| Hold | |||||||||||

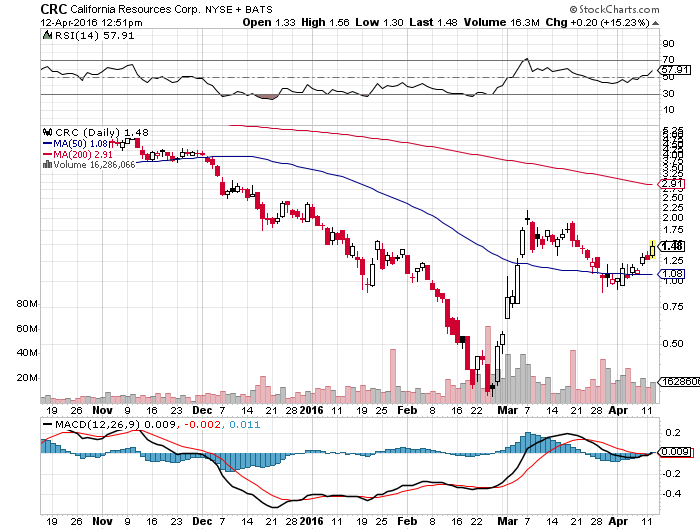

| Short Term Indicators Average: 80% Buy | |||||||||||

| 20-Day Average Volume – 18,995,703 | |||||||||||

| Medium Term Indicators | |||||||||||

| Hold | |||||||||||

| Buy | |||||||||||

| Sell | |||||||||||

| Buy | |||||||||||

| Medium Term Indicators Average: 25% Buy | |||||||||||

| 50-Day Average Volume – 19,247,926 | |||||||||||

| Long Term Indicators | |||||||||||

| Hold | |||||||||||

| Sell | |||||||||||

| Sell | |||||||||||

| Long Term Indicators Average: 67% Sell | |||||||||||

| 100-Day Average Volume – 14,254,258 | |||||||||||

| Overall Average: 32% Buy | |||||||||||

|

|||||||||||

| Click on the indicator for a graphical interpretation, or visit the Education Center for information on the studies. | |||||||||||

Sources: Barchart, Risers and fallers, yahoo finance

Broad Street Alerts has not been compensated for this report and we do not hold any positions in CRC.