See Full Report below….

About Broad Street Alerts:

Big opportunities in Small Cap’s

Broad Street Alerts recent profiles and track record, 217% in verifiable potential gains for our

members in the last 3 small cap alerts alone!

• February 10th, 2016- (NASDAQ: BONT) opened $1.65/share hit a high of $3.00/share within 30 days our members gains- 83%

• March 7th, 2016-(NYSE-MKT: FSI) opened at .91/share and hit 1.10/share within 5 days for gains of 21% for our members.

• March 24th, 2016- (NASDAQ: ICLD) opened at $.77/share it a high of $1.15/share within 2 days for gains of 49% for our members.

April 11th, 2016 – (NASDAQ: FNJN) called at $1.07/share hit $1.76/share in 3 days for 64% gains for our members.

These are numbers that make traders drool. Any trader in any market would fall all over themselves to

see numbers like this. So if you’ve been on the fence, perhaps it’s time to start doing some research and

verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest

of the small-cap newsletters as the best in business. We know with a large following comes a large

responsibility as we have everyone from institutional investors to the beginner following our profiled

securities in our newsletters. This is something we take very seriously always seeking small cap growth

companies that have both near and long-term potential for our members.

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our

VIP SMS/text alert service for free, simply text the word “Alerts” to the phone number 25827 from your cell phone.

FELP report

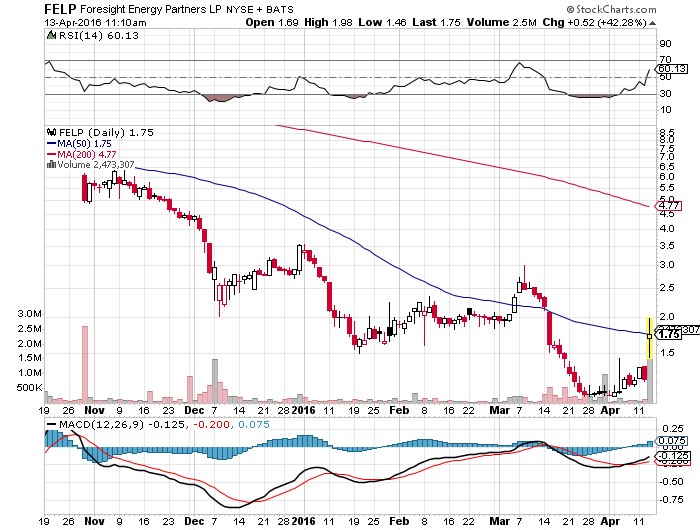

Shares of Foresight Energy LP (NASDAQ:FELP) have received a consensus recommendation of “Hold” from the twelve research firms that are covering the firm, AnalystRatings.NET reports. Three analysts have rated the stock with a sell rating and nine have given a hold rating to the company. The average 12 month price target among brokerages that have covered the stock in the last year is $6.63.

Shares of Foresight Energy (NASDAQ:FELP) opened at 1.23 on Friday. The company has a 50-day moving average of $1.65 and a 200 day moving average of $3.45. The stock has a market cap of $160.08 million and a PE ratio of 1.34. Foresight Energy has a one year low of $1.07 and a one year high of $15.32.

Foresight Energy (NASDAQ:FELP) last posted its earnings results on Tuesday, March 15th. The company reported ($0.55) earnings per share (EPS) for the quarter, missing the Zacks’ consensus estimate of $0.05 by $0.60. During the same period in the previous year, the business posted $0.22 earnings per share. The company had revenue of $239.20 million for the quarter, compared to analysts’ expectations of $235.50 million. The business’s quarterly revenue was down 19.5% on a year-over-year basis. On average, analysts predict that Foresight Energy will post ($0.46) earnings per share for the current year.

A number of research firms recently issued reports on FELP. Deutsche Bank downgraded shares of Foresight Energy from a “hold” rating to a “sell” rating and dropped their target price for the stock from $6.00 to $2.00 in a research report on Thursday, December 17th. FBR & Co. restated a “market perform” rating on shares of Foresight Energy in a report on Wednesday, March 16th. Zacks Investment Research upgraded Foresight Energy from a “sell” rating to a “hold” rating in a report on Tuesday, February 9th. Finally, Morgan Stanley cut Foresight Energy from an “overweight” rating to an “equal weight” rating and set a $12.00 price target for the company. in a report on Friday, January 22nd.

Foresight Energy LP (NASDAQ:FELP) is engaged in the mining and marketing of coal from reserves and operations located in the Illinois Basin. The Company controls over three billion tons of coal in the state of Illinois. Its reserves consist principally of three contiguous blocks of high heat content (high Btu) thermal coal, which are used for longwall operations.

If an agreement on the terms of an out-of-court restructuring is not reached with our Noteholders and other lenders, it may be necessary for us to file a voluntary petition for relief under Chapter 11 of the United States Bankruptcy Code in order to implement a restructuring, or our creditors could force us into an involuntary bankruptcy. If a plan of reorganization is implemented in a bankruptcy proceeding, it is likely that our equity holders would be entitled to little or no recovery, and their claims and interests would be canceled for little or no consideration.

Distributions & Outlook

FELP announced that the Board of Directors has suspended its quarterly distribution to unitholders. FELP is also suspending guidance for 2016 pending an outcome in the negotiation with its lenders.

Sources:

SleekMonkey.com

Stockcharts.com

Zacks.com

Streetinsider.com

Broad Street Alerts has not been compensated for the mention of FELP and we do not hold any positions.