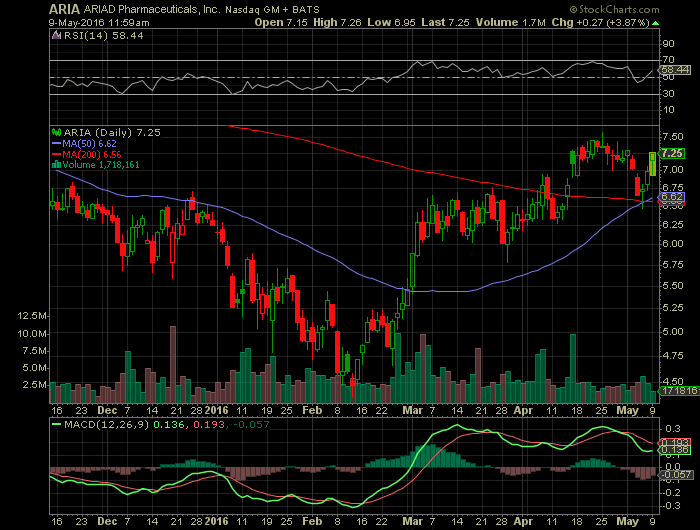

See feature articles below: (Nasdaq: ARIA)

About Broad Street Alerts:

Big opportunities in Small Cap’s

Broad Street Alerts recent profiles and track record, 217% in verifiable potential gains for our members on the last 4 small cap alerts alone!

February 10th, 2016- (NASDAQ: BONT) opened $1.65/share hit a high of $3.00/share within 30 days our member potential gains- 83%

March 7th, 2016-(NYSE-MKT: FSI) opened at .91/share and hit 1.10/share within 5 days for gains of 21% for our members.

March 24th, 2016- (NASDAQ: ICLD) opened at $.77/share it a high of $1.15/share within 2 days for gains of 49% for our members.

These are numbers that make traders drool. Any trader in any market would fall all over themselves to see numbers like this. So if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP SMS/text alert service for free, simply text the word “Alerts” to the phone number 25827 from your cell phone.

Report on : (Nasdaq: INCY, ARIA)

Incyte (INCY – Get Report) chose to buy a turnkey European commercial operation instead of building one. The company found a willing seller in Ariad Pharmaceuticals (ARIA – Get Report) , which was looking to shed its European operations to save money.

Under terms of the deal announced Monday, Incyte is paying $140 million to acquire Ariad’s European operations, which includes 125 sales and marketing employees and European rights to the leukemia drug Iclusig. In addition to the cash payment, Incyte will pay Ariad a royalty of 32%-50% on future European Iclusig sales.

Iclusig sales in Europe were $27 million in 2015.

The deal makes good strategic sense for both companies. Incyte will use its new European business hub for the future launch of cancer and immunology drugs from its pipeline, if eventually approved. Generating a small amount of extra revenue from Iclusig, net the Ariad royalty, is a bonus.

Must Read: Acadia Drug Approval May Entice Biogen, Teva as Buyers

Ariad, in turn, sheds an expensive European business and can focus Iclusig marketing efforts on the U.S. The deal includes a buyback provision that allows a potential acquirer of Ariad to repurchase Iclusig European rights from Incyte.

Iclusig U.S. sales in 2015 totaled $85.7 million.

Separately, Incyte reported $183 million in Jakafi sales for the first quarter, slightly below consensus expectations. The company refined 2016 Jakafi sales guidance to $815 million-$830 million, which already brackets current consensus. Novartis co-markets Jakafi, which is approved to treat blood-related diseases, including the bone marrow disorder myelofibrosis.

Incyte’s pipeline includes drugs used by the immune system to target and kill cancer cells.

Incyte shares are flat at $71.08 in Monday trading. Ariad shares are up 2% to $7.12.

Source: The Street & ACAD Charts

Broad street alerts has not been compensated for the mention of any publicly traded companies in this article nor do we own positions in any of the companies in this article.