![]()

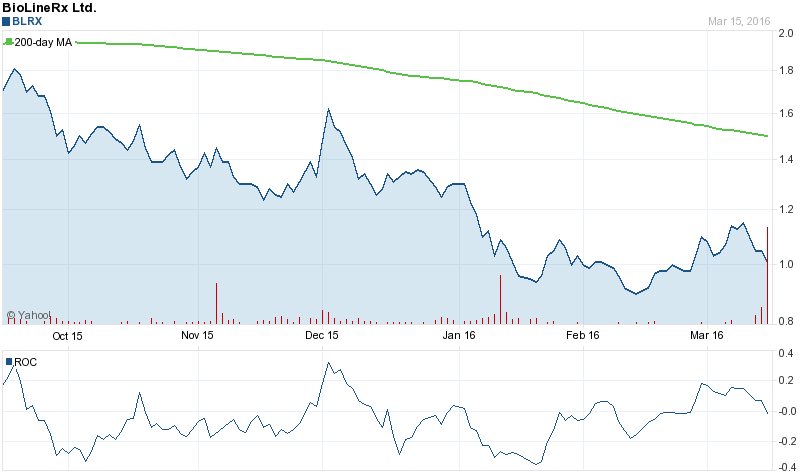

Bioline RX Ltd (NASDAQ:BLRX) – Equities research analysts at Roth Capital dropped their Q3 2016 earnings per share estimates for shares of Bioline RX in a research report issued on Thursday, according to Zacks Investment Research. Roth Capital analyst J. Pantginis now anticipates that the brokerage will post earnings per share of ($0.09) for the quarter, down from their prior forecast of ($0.08). Roth Capital has a “Buy” rating and a $7.00 price objective on the stock. Roth Capital also issued estimates for Bioline RX’s FY2016 earnings at ($0.33) EPS and FY2017 earnings at ($0.36) EPS.

A number of other brokerages have also issued reports on BLRX. Zacks Investment Research raised shares of Bioline RX from a “hold” rating to a “buy” rating and set a $1.50 price objective for the company in a report on Wednesday, November 18th. JMP Securities dropped their price objective on shares of Bioline RX from $3.50 to $3.00 and set a “market outperform” rating for the company in a report on Wednesday, March 9th. Finally, JPMorgan Chase & Co. dropped their price objective on shares of Bioline RX from $3.50 to $3.00 and set a “market outperform” rating for the company in a report on Wednesday, March 9th. Five research analysts have rated the stock with a buy rating, The stock presently has an average rating of “Buy” and an average price target of $3.65.

Bioline RX (NASDAQ:BLRX) opened at 1.01 on Monday. Bioline RX has a 12 month low of $0.85 and a 12 month high of $2.80. The stock’s market cap is $55.19 million. The stock has a 50 day moving average of $1.02 and a 200-day moving average of $1.30.

Bioline RX (NASDAQ:BLRX) last issued its quarterly earnings data on Thursday, March 10th. The company reported ($0.07) earnings per share (EPS) for the quarter, missing analysts’ consensus estimates of ($0.06) by $0.01.

BioLine RX Ltd is an Israel-based company engaged in the development of therapeutics, from preclinical-stage development to advanced clinical trials, for a range of medical needs. Its clinical therapeutic candidates under development consist of BL-1020 that is in Phase II/III clinical trials to improve cognitive function in schizophrenia patients; BL-1040, which is under pivotal CE-Mark registration trial for the prevention of cardiac remodeling following an acute myocardial infarction; BL-5010, which has completed Phase I/II clinical trials for non-surgical removal of skin lesions; BL-1021 that has completed Phase Ia clinical trial for the treatment of neuropathic pain or pain that results from damage to nerve fibers, and BL-7040, a synthetic oligonucleotide, which is in Phase II clinical trial for the treatment of inflammatory bowel disease.

12 Month Chart for NASDAQ:BLRX

Source: Financial market news