About Broad Street Alerts:

Big opportunities in Small Cap’s

Broad Street Alerts recent profiles and track record, 217% in verifiable potential gains for our members on the last 4 small cap alerts alone!

February 10th, 2016- (NASDAQ: BONT) opened $1.65/share hit a high of $3.00/share within 30 days our member potential gains- 83%

March 7th, 2016-(NYSE-MKT: FSI) opened at .91/share and hit 1.10/share within 5 days for gains of 21% for our members.

March 24th, 2016- (NASDAQ: ICLD) opened at $.77/share it a high of $1.15/share within 2 days for gains of 49% for our members.

April 11th, 2016 – (NASDAQ: FNJN) called at $1.07/share hit $1.76/share in 3 days for 64% gains for our members.

These are numbers that make traders drool. Any trader in any market would fall all over themselves to see numbers like this. So if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP SMS/text alert service for free, simply text the word “Alerts” to the phone number 25827 from your cell phone.

PRGN Report

A number of investment brokers have recently updated their price targets on shares of Paragon Shipping Inc. (PRGN). According to the latest broker reports outstanding on Friday 1st of April, 0 analysts have a rating of “strong buy”, 0 analysts “buy”, 0 analysts “neutral”, 0 analysts “sell” and 0 analysts “strong sell”.

Most recent broker ratings

04/27/2015 – Paragon Shipping Inc. had its “buy” rating reiterated by analysts at Jefferies. They now have a USD 2.5 price target on the stock.

04/01/2015 – Paragon Shipping Inc. had its “hold” rating reiterated by analysts at MLV & Co. They now have a USD 2 price target on the stock.

01/07/2015 – Paragon Shipping Inc. was downgraded to “hold” by analysts at Canaccord Genuity. They now have a USD 4 price target on the stock.

10/08/2014 – Cowen began new coverage on Paragon Shipping Inc. giving the company a “market perform” rating. They now have a USD 5.5 price target on the stock.

10/08/2014 – Paragon Shipping Inc. had its “buy” rating reiterated by analysts at Maxim Group. They now have a USD 6 price target on the stock.

10/03/2014 – Wunderlich began new coverage on Paragon Shipping Inc. giving the company a “hold” rating. They now have a USD 5 price target on the stock.

09/18/2014 – Paragon Shipping Inc. had its “hold” rating reiterated by analysts at Clarkson Capital. They now have a USD 7.5 price target on the stock.

09/10/2014 – Paragon Shipping Inc. was upgraded to “neutral” by analysts at Zacks. They now have a USD 5.4 price target on the stock.

05/28/2014 – ING began new coverage on Paragon Shipping Inc. giving the company a “hold” rating.

12/10/2013 – Paragon Shipping Inc. was upgraded to “buy” by analysts at Global Hunter Securities. They now have a USD 10 price target on the stock.

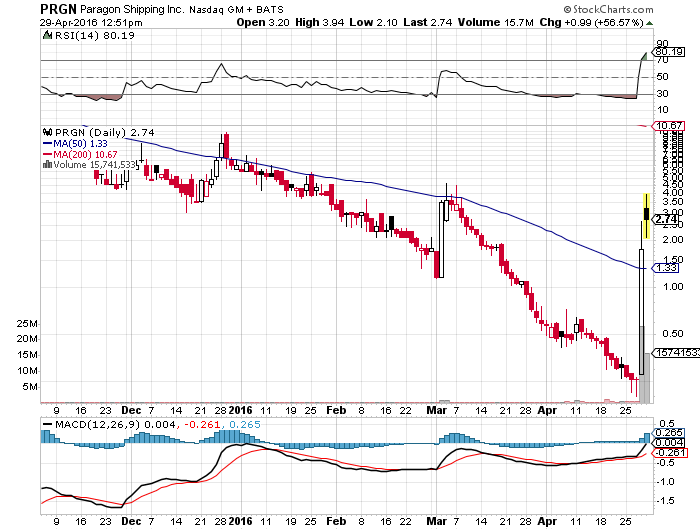

The share price of Paragon Shipping Inc. (PRGN) was down -9.11% during the last day of trading, with a day high of 0.76. 152394 shares were traded during the last session.

The stock’s 50 day moving average is 1.95 and its 200 day moving average is 5.92. The stock’s market capitalization is 14.67M. Paragon Shipping Inc. has a 52-week low of 0.53 and a 52-week high of 45.60.

Paragon Shipping Inc. is a global provider of shipping transportation services. The Company specializes in transporting drybulk cargoes, including such commodities as iron ore, coal, grain and other materials, along shipping routes across the world. Its operating fleet consists of eight Panamax drybulk carriers, two Ultramax drybulk carriers, two Supramax drybulk carriers and four Handysize drybulk carriers with an aggregate capacity of over 980,380 deadweight tonnage (dwt) and an average age of 7.6 years. Allseas Marine S.A. (Allseas) and Seacommercial Shipping Services S.A (Seacommercial) provide commercial and technical management services for its fleet. The Company primarily employs its vessels in the spot charter market, on short-term time charters or on voyage charters, ranging from 10 days to three months.

Source- Risers and fallers, stock charts

Broad street alerts has not been compensated for the mention of any publicly traded companies in this article nor do we own positions in any of the companies in this article.

Broad Street Alerts was previously compensated eighteen thousand five hundred dollars by star media llc for the mention of FNJN however, that contract has expired.

Tags:

Stock market

PRGN

Nasdaq: PRGN

Hot small cap stocks

small cap stock picks

Biotech stocks

FDA approval stocks

FDA calendar

PDUFA date set

micro cap stocks

Best stocks 2016

Hottest small cap stocks