See feature articles below:

About Broad Street Alerts:

Big opportunities in Small Cap’s

Broad Street Alerts recent profiles and track record, 153% in verifiable potential gains for our members on the last 3 small cap alerts alone!

February 10th, 2016- (NASDAQ: BONT) opened $1.65/share hit a high of $3.00/share within 30 days our member potential gains- 83%

March 7th, 2016-(NYSE-MKT: FSI) opened at .91/share and hit 1.10/share within 5 days for gains of 21% for our members.

March 24th, 2016- (NASDAQ: ICLD) opened at $.77/share it a high of $1.15/share within 2 days for gains of 49% for our members.

These are numbers that make traders drool. Any trader in any market would fall all over themselves to see numbers like this. So if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP SMS/text alert service for free, simply text the word “Alerts” to the phone number 25827 from your cell phone.

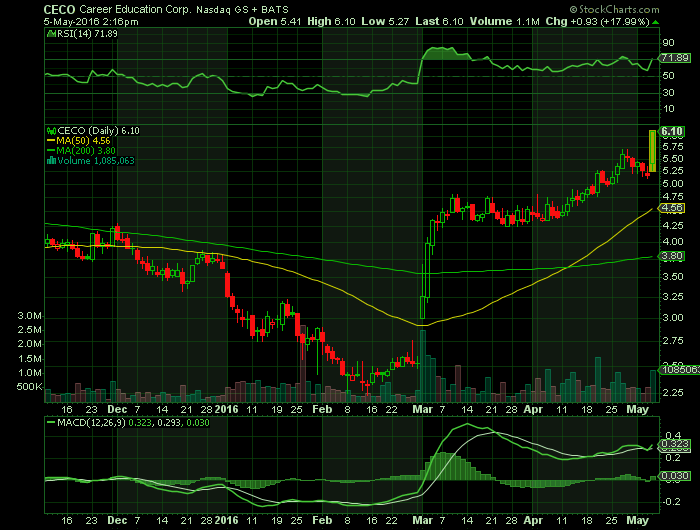

Report for: CECO

Operating income for the quarter was positive $7 million, versus prior-year first quarter loss of $24.4 million. This can be attributed to lower operating costs as a result of our strategic initiatives. Also, as a result of our decision to teach-out Culinary Arts, we received a cost benefit from the reduction of our admission costs and marketing expenses. We expect our operating costs will continue to improve throughout the remainder of the year. However, as Todd mentioned, the year-over-year differences will start to normalize in the second half of this year as the impact of our strategic initiatives begin to anniversary.

Adjusted EBITDA performance followed a similar pattern of improvement. We ended the quarter with $189.5 million of cash, cash equivalents, restricted cash, and available-for-sale short-term and long-term investments. As was discussed on previous calls, we are carefully managing our cash.

For the quarter, cash flow from operations was negative $10.6 million, which compares favorably to negative cash flow from operations of $20.2 million for the first quarter of 2015. This improvement in cash flow was primarily attributed to lower operating costs. Capital expenditures for the quarter were less than $1 million.

Moving to slide 5, here we highlight the results of the University Group. You can see the 4.9% improvement year over year in revenue. This can be attributed, in part, to improved retention and degree mix of our students.

Overall enrollment within the University Group has improved slightly. Operating income and adjusted EBITDA, improved $9.4 million and $8.9 million, respectively, versus prior-year quarter. Again, attributed to improvement in revenue and lower operating costs, partially offset by increased reserves for bad debt expense.

Turning now to slide 6. We highlight the result of our Culinary Arts and Transitional segments, which are in teach-out. As previously mentioned, revenue declined year over year in both segments, but the overall financial performance has improved because we have effectively managed our cost structure in response to the declining student enrollment. All while supporting our students as they complete their education.

Results also benefited from the non-recurrence of a $6 million asset impairment charge that occurred in 2015. As a reminder, as the teach-out strategy progresses, revenue will continue to decline. but we will maintain our commitment to our students. The impact this has on our financials will increase as we progress towards completion.

Lastly, we wanted to update everyone on our outlook. Slide 7 is how this was displayed on the previous call, and I do not see any reason to change it. We believe we are on path to achieve the objectives as they are outlined on this page. In particular, our cash balance is in line with this outlook, and nothing material has changed regarding our expectations. Recall, the cash outlook incorporates the impacts of the teach-outs, including severance costs and lease termination costs.

This concludes my summary. For additional information, please refer to the appendix included in this presentation. There you will find a summary of the key assumptions contained within our outlook, as well as reconciliations of GAAP to non-GAAP items.

Source – Reuters

Broad street alerts has not been compensated for the mention of any publicly traded companies in this article nor do we own positions in any of the companies in this article.

Stock market

Hot small cap stocks

small cap stock picks

Biotech stocks

FDA approval stocks

FDA calendar

Trade stocks

Become a day trader

Day trade stocks for a living

PDUFA date set

micro cap stocks

Best stocks 2016

Hottest small cap stocks

Best stock picks

Who to follow for stock picks

Apple news stock picks

Stock picks on apple news