See Full Report on Berkshire below….

About Broad Street Alerts:

Big opportunities in Small Cap’s

Broad Street Alerts recent profiles and track record, 153% in verifiable potential gains for our

members in the last 3 small cap alerts alone!

• February 10th, 2016- (NASDAQ: BONT) opened $1.65/share hit a high of $3.00/share within 30 days our members gains- 83%

• March 7th, 2016-(NYSE-MKT: FSI) opened at .91/share and hit 1.10/share within 5 days for gains of 21% for our members.

• March 24th, 2016- (NASDAQ: ICLD) opened at $.77/share it a high of $1.15/share within 2 days for gains of 49% for our members.

These are numbers that make traders drool. Any trader in any market would fall all over themselves to

see numbers like this. So if you’ve been on the fence, perhaps it’s time to start doing some research and

verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest

of the small-cap newsletters as the best in business. We know with a large following comes a large

responsibility as we have everyone from institutional investors to the beginner following our profiled

securities in our newsletters. This is something we take very seriously always seeking small cap growth

companies that have both near and long-term potential for our members.

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our

VIP SMS/text alert service for free, simply text the word “Alerts” to the phone number 25827 from your cell phone.

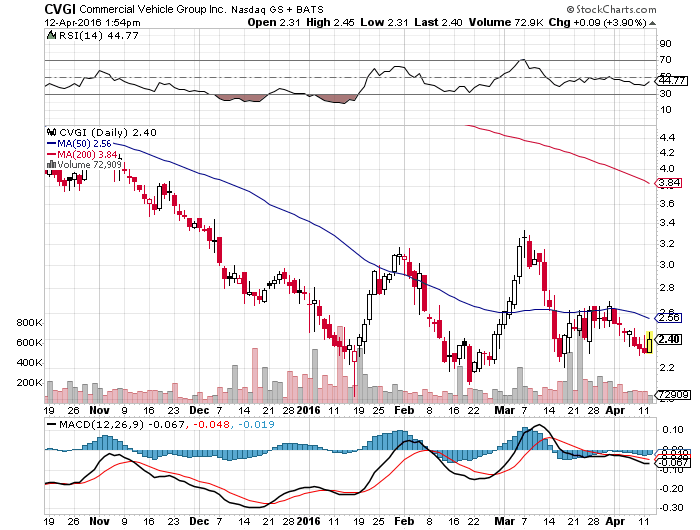

Our favorite is CVGI earnings due in early May with great chart setup- 24M in the float

Commercial Vehicle Group Inc. (NASDAQ: CVGI) had a 10% owner of the company buying shares in a big way. The investors purchased a total of 643,300 shares at prices that ranged from $2.47 to $2.50. The total for the trade came to $1.5 million. The company designs, engineers, produces and sells various cab-related products and systems in North America, Europe and the Asia/Pacific regions. The stock closed Friday at $2.52.

Mattress Firm Holding Corp. (NASDAQ: MFRM) had a larger shareholder adding to positions this past week. Berkshire Partners made two significant buys. Earlier in the week, the company bought 205,409 shares of the stock at prices that fell between $39.02 and $39.48 apiece. The total for that trade came to $8 million. Later in the week, the company bought an additional 234,416 shares at share prices from $41.50 to $42.48, which cost an additional $10 million. The stock closed on Friday at $42.31, so the timing looks very good.

Nimble Storage Inc. (NASDAQ: NMBL) was a hot tech stock that has been hit hard, and a director of the company decided to acquire shares last week. That director bought a block of 40,000 shares at prices that ranged between $6.96 and $7.19. The total for the purchase came to $300,000. The company provides flash-optimized storage platforms. The company’s software and storage systems handle various mainstream applications, including virtual desktops, databases, email, collaboration and analytics. The stock closed Friday at $7.77, so the timing looks good.

Patriot National Inc. (NYSE: PN) had a director, who is also a 10% owner of the company, buying shares this past week. That director bought 89,200 shares at prices that fell between $6.94 and $7.75. The total for the buy came to $700,000. The director also bought an additional 100,000 shares at $5.51 to $6.00 a share, for $600,000. The company provides technology-enabled outsourcing solutions within the workers’ compensation marketplace for insurance carriers, local governments, reinsurance captives and other employers in the United States. The stock closed Friday at $8.51, up 10.5% on the day.

Graham Holdings Corp.‘s (NYSE: GHC) president chief executive officer, Timothy O’Shaughnessy, bought some of the stock last week. At the whopping price of $464 per share, his purchase of 1,100 shares cost him some $500,000. Graham Holdings is an education and media company, and the stock closed Friday at $488.73, so the timing looks good here too.

These companies also reported insider buying this week: Demandware Inc. (NYSE: DWRE), Flex Pharma Inc. (NASDAQ: FLKS), Mirati Therapeutics Inc. (NASDAQ: MRTX), OvaScience Inc. (NASDAQ: OVAS) and Rentech Nitrogen Partners L.P. (NYSE: RGEN).

Source-Insider Monkey

Broad Street Alerts does not hold any positions in any of the mentioned securities in this post and we have not been compensated for this post.