See feature report below: (Nasdaq: CECE)

About Broad Street Alerts:

Big opportunities in Small Cap’s

Broad Street Alerts recent profiles and track record, 153% in verifiable potential gains for our members on the last 3 small cap alerts alone!

February 10th, 2016- (NASDAQ: BONT) opened $1.65/share hit a high of $3.00/share within 30 days our member potential gains- 83%

March 7th, 2016-(NYSE-MKT: FSI) opened at .91/share and hit 1.10/share within 5 days for gains of 21% for our members.

March 24th, 2016- (NASDAQ: ICLD) opened at $.77/share it a high of $1.15/share within 2 days for gains of 49% for our members.

These are numbers that make traders drool. Any trader in any market would fall all over themselves to see numbers like this. So if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP SMS/text alert service for free, simply text the word “Alerts” to the phone number 25827 from your cell phone.

Article -(Nasdaq: CECE)

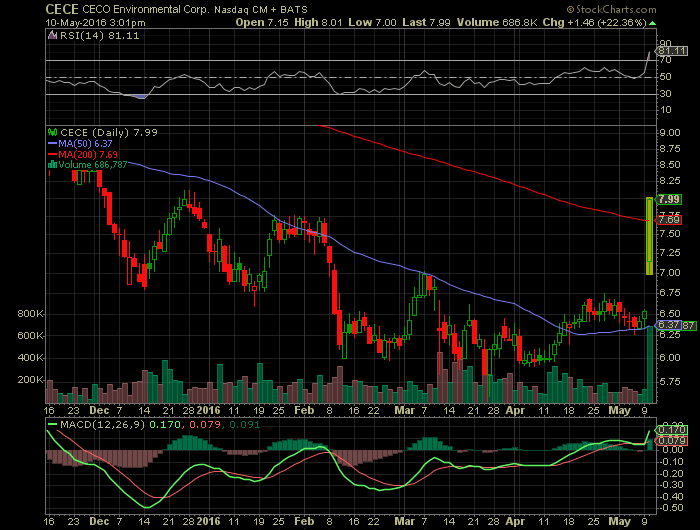

CECO Environmental Corp. (NASDAQ:CECE) shares traded up 18.1% during mid-day trading on Tuesday following a better than expected earnings announcement, MarketBeat.Com reports. The company traded as high as $7.99 and last traded at $7.71, with a volume of 513,546 shares traded. The stock had previously closed at $6.53.

The company reported $0.18 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.14 by $0.04. During the same quarter in the prior year, the business posted $0.21 EPS. The business had revenue of $103.20 million for the quarter, compared to analysts’ expectations of $99.66 million. The business’s revenue for the quarter was up 27.4% compared to the same quarter last year.

Several analysts recently issued reports on the company. Zacks Investment Research cut CECO Environmental Corp. from a “hold” rating to a “sell” rating in a research report on Monday, March 14th. Drexel Hamilton cut CECO Environmental Corp. from a “buy” rating to a “hold” rating in a report on Friday, March 11th. Roth Capital cut their price target on CECO Environmental Corp. from $16.00 to $12.00 and set a “buy” rating for the company in a report on Friday, March 11th. Needham & Company LLC restated a “buy” rating and set a $10.00 price target (down previously from $13.00) on shares of CECO Environmental Corp. in a report on Friday, March 11th. Finally, Canaccord Genuity restated a “buy” rating and set a $12.00 price target on shares of CECO Environmental Corp. in a report on Friday, March 11th. One analyst has rated the stock with a sell rating, three have issued a hold rating and five have given a buy rating to the company. CECO Environmental Corp. has an average rating of “Hold” and a consensus price target of $10.53.

Several large investors recently bought and sold shares of the stock. Wells Fargo & Company MN raised its stake in CECO Environmental Corp. by 12.7% in the fourth quarter. Wells Fargo & Company MN now owns 661,801 shares of the company’s stock valued at $5,082,000 after buying an additional 74,362 shares during the last quarter. Olstein Capital Management L.P. raised its stake in CECO Environmental Corp. by 16.8% in the fourth quarter. Olstein Capital Management L.P. now owns 590,000 shares of the company’s stock valued at $4,531,000 after buying an additional 85,000 shares during the last quarter. Morgan Stanley raised its stake in CECO Environmental Corp. by 11.2% in the fourth quarter. Morgan Stanley now owns 401,153 shares of the company’s stock valued at $3,081,000 after buying an additional 40,290 shares during the last quarter. California State Teachers Retirement System raised its stake in CECO Environmental Corp. by 1.8% in the fourth quarter. California State Teachers Retirement System now owns 53,871 shares of the company’s stock valued at $414,000 after buying an additional 975 shares during the last quarter. Finally, Punch & Associates Investment Management Inc. raised its stake in CECO Environmental Corp. by 17.2% in the fourth quarter. Punch & Associates Investment Management Inc. now owns 576,987 shares of the company’s stock valued at $4,431,000 after buying an additional 84,546 shares during the last quarter.

The company’s market capitalization is $261.79 million. The stock’s 50 day moving average is $6.29 and its 200-day moving average is $7.27.

CECO Environmental Corp. is an environmental technology company focused on solutions in the product recovery, air pollution control, fluid handling and filtration industries. The Company is focused on engineering, designing, building, and installing systems that capture, clean and destroy airborne contaminants from industrial facilities, as well as equipment that controls emissions from such facilities, as well as fluid handling and filtration systems.

CECO Environmental Corp. Press Release:

CINCINNATI, Ohio, May 10, 2016 — CECO Environmental Corp. (Nasdaq:CECE), a leading global environmental, energy and fluid handling technology company, today reported its financial results for the first quarter of 2016.

“Despite some ongoing macroeconomic challenges continuing into 2016, we recorded bookings of $120 million in the quarter, resulting in backlog of $228 million, both of which are all-time records for CECO. We also delivered margin expansion, strong free cash flow and significant debt pay down. I am very pleased we have now fully completed the integration of our Peerless acquisition in less than nine months since the closing of the transaction. We have not only fully achieved the promised operational and overall business synergies of $15 million more than one year ahead of schedule, but we now expect to achieve $18 million in total synergies. As a result, Peerless’ adjusted EBITDA was $5 million for the first quarter of 2016 versus an operating loss in their same quarter last year,” said CEO Jeff Lang. “In addition, our continued focus on organic sales, recurring revenue growth, and working capital initiatives enabled debt repayment and a reduction in our leverage ratios. Lastly, we are very pleased that our sequential bookings grew from $100 million in the fourth quarter of 2015 to $120 million in the first quarter of 2016,” said Jeff Lang.

“While we anticipate some macroeconomic shifting in a few markets and regions for the remainder of the year, we are confident that the actions we took in 2015 and our diversity of end markets, geographies and revenue streams provide us with a foundation to drive profitable growth through various cycles. The direction and core of our business is fundamentally strong, and we have the right team in place to deliver earnings growth, margin expansion and sales improvement into the future,” concluded Jeff Lang.

Revenue in the first quarter of 2016 was $103.2 million, up 27% from $81.0 million in the prior-year period. Recent acquisitions(1) contributed $24.9 million of revenue in the first quarter of 2016.

Operating income was $5.8 million for the first quarter of 2016 (5.6% margin), compared with $3.0 million in the prior-year period (3.7% margin). Operating income on a non-GAAP basis was $10.9 million for the first quarter of 2016 (10.6% margin), compared with $7.5 million in the prior-year period (9.3% margin).

Net income was $3.1 million for the first quarter of 2016, compared with $0.2 million in the prior year period. Net income on a non-GAAP basis was $6.1 million for the first quarter of 2016, compared with $5.7 million in the prior-year period.

Net income per diluted share was $0.09 for the first quarter of 2016, compared with net income per diluted share of $0.01 in the prior-year period. Non-GAAP net income per diluted share was $0.18 for the first quarter of 2016, compared with $0.21 for the prior-year period.

Cash and cash equivalents were $33.4 million and bank debt was $170.6 million, as of March 31, 2016, compared with $34.2 million and $177.3 million, respectively, as of December 31, 2015.

BACKLOG AND BOOKINGS

Total backlog at March 31, 2016 was $228.1 million as compared with $211.2 million on December 31, 2015, and $153.0 million on March 31, 2015.

Bookings were $120.1 million for the first quarter of 2016, compared with $93.9 million in the prior year, an increase of 28%. Bookings were $100.3 million in the fourth quarter of 2015.

QUARTERLY DIVIDENDS

On May 6, 2016, CECO’s Board of Directors approved a quarterly dividend of $0.066 per share. The dividend will be paid on June 30, 2016 to all stockholders of record on close of business on June 18, 2016. CECO initiated a Dividend Reinvestment Plan (“DRIP”) in 2012 that provides for the voluntary reinvestment of dividends by its stockholders.

CONFERENCE CALL

A conference call is scheduled for today at 9:30AM ET to discuss the first quarter 2016 results.

The conference call may be accessed by dialing +1.877.407.3982 (Toll-Free) in the U.S. and Canada or by dialing +1.201.493.6780 for international calls. A replay will be available from 12:30 p.m. ET on the day of the call until May 24, 2016 at 11:59 p.m. ET. The replay may be accessed by dialing +1.877.870.5176 (Toll-Free) in the U.S. and Canada or by dialing +1.858.384.5517 for international calls and entering passcode 13636111.

The live webcast and slides can also be accessed at http://www.cecoenviro.com/investor-relations.

(1) Acquisitions completed within the past twelve months

ABOUT CECO ENVIRONMENTAL

CECO is a diversified global provider of leading engineered technologies to the environmental, energy, and fluid handling and filtration industrial segments, targeting specific niche-focused end markets through an attractive asset-light business model, strategically balanced across the world. CECO targets its over $5 billion+ of installed-base, specifically to expand and grow a higher recurring revenue of aftermarket products and services. CECO’s brands, technologies and solutions have been evolving for well over 50 years to become leading-class technologies in specific niche global end markets, including natural gas turbine power, refinery & petrochemical engineered cyclones and mid-stream energy pipeline gas transmission. CECO is listed on NASDAQ under the ticker symbol “CECE”. For more information, please visit http://www.cecoenviro.com/.

Contacts:

Ed Prajzner, Chief Financial Officer & Secretary

800.333.5475

eprajzer@cecoenviro.com

Tracy Krumme, Vice President of Investor Relations

513.458.2610

tkrumme@cecoenviro.com

NOTE REGARDING NON-GAAP FINANCIAL MEASURES

CECO is providing the non-GAAP historical financial measures presented above as the Company believes that these figures are helpful in allowing individuals to better assess the ongoing nature of CECO’s core operations. A “non-GAAP financial measure” is a numerical measure of a company’s historical financial performance that excludes amounts that are included in the most directly comparable measure calculated and presented in the GAAP statement of operations.

Non-GAAP gross margin, non-GAAP operating income, non-GAAP net income, non-GAAP gross profit margin, non-GAAP operating margin, non-GAAP earnings per basic and diluted share and adjusted EBITDA, as we present them in the financial data included in this press release, have been adjusted to exclude the effects of expenses related to property, plant equipment valuation adjustments, acquisition and integration expense activities including retention, legal, accounting, banking, amortization and contingent earnout expenses, foreign currency re-measurement, intangible asset impairment, legal reserves and the associated tax benefit of these charges. Management believes that these items are not necessarily indicative of the Company’s ongoing operations and their exclusion provides individuals with additional information to compare the Company’s results over multiple periods. Management utilizes this information to evaluate its ongoing financial performance. Our financial statements may continue to be affected by items similar to those excluded in the non-GAAP adjustments described above, and exclusion of these items from our non-GAAP financial measures should not be construed as an inference that all such costs are unusual or infrequent.

Non-GAAP gross margin, non-GAAP operating income, non-GAAP net income, non-GAAP gross profit margin, non-GAAP operating margin, non-GAAP earnings per basic and diluted shares and adjusted EBITDA are not calculated in accordance with GAAP, and should be considered supplemental to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. Non-GAAP financial measures have limitations in that they do not reflect all of the costs associated with the operations of our business as determined in accordance with GAAP. As a result, you should not consider these measures in isolation or as a substitute for analysis of CECO’s results as reported under GAAP.

In accordance with the requirements of Regulation G issued by the Securities and Exchange Commission, non-GAAP gross margin, non-GAAP operating income, non-GAAP net income, non-GAAP gross profit margin, non-GAAP operating margin, non-GAAP earnings per basic and diluted share and adjusted EBITDA, stated in the tables above present the most directly comparable GAAP financial measure and reconcile to the most directly comparable GAAP financial measures.

SAFE HARBOR

Any statements contained in this press release other than statements of historical fact, including statements about management’s beliefs and expectations, are forward-looking statements and should be evaluated as such. These statements are made on the basis of management’s views and assumptions regarding future events and business performance. Words such as “estimate,” “believe,” “anticipate,” “expect,” “intend,” “plan,” “target,” “project,” “should,” “may,” “will” and similar expressions are intended to identify forward-looking statements. Forward-looking statements (including oral representations) involve risks and uncertainties that may cause actual results to differ materially from any future results, performance or achievements expressed or implied by such statements. These risks and uncertainties include, but are not limited to: our ability to successfully integrate acquired businesses and realize the synergies from acquisitions, including PMFG, as well as a number of factors related to our business including economic and financial market conditions generally and economic conditions in CECO’s service areas; dependence on fixed price contracts and the risks associated therewith, including actual costs exceeding estimates and method of accounting for contract revenue; fluctuations in operating results from period to period due to seasonality of the business; the effect of growth on CECO’s infrastructure, resources, and existing sales; the ability to expand operations in both new and existing markets; the potential for contract delay or cancellation; changes in or developments with respect to any litigation or investigation; the potential for fluctuations in prices for manufactured components and raw materials; the substantial amount of debt incurred in connection with our recent acquisitions and our ability to repay or refinance it or incur additional debt in the future; the impact of federal, state or local government regulations; economic and political conditions generally; and the effect of competition in the environmental, energy and fluid handling and filtration industries. These and other risks and uncertainties are discussed in more detail in CECO’s filings with the Securities and Exchange Commission, including our reports on Form 10-K and Form 10-Q. Many of these risks are beyond management’s ability to control or predict. Should one or more of these risks or uncertainties materialize, or should the assumptions prove incorrect, actual results may vary in material aspects from those currently anticipated. Investors are cautioned not to place undue reliance on such forward-looking statements as they speak only to our views as of the date the statement is made. All forward-looking statements attributable to CECO or persons acting on behalf of CECO are expressly qualified in their entirety by the cautionary statements and risk factors contained in this press release and CECO’s respective filings with the Securities and Exchange Commission. Furthermore, forward-looking statements speak only as of the date they are made. Except as required under the federal securities laws or the rules and regulations of the Securities and Exchange Commission, CECO undertakes no obligation to update or review any forward-looking statements, whether as a result of new information, future events or otherwise.

Source: CECO Environmental Corp., Web Breaking News, and StockCharts.com

DISCLAIMER

Broad Street Alerts is a wholly owned subsidiary of Small Cap Specialists LLC, herein referred to as SCS LLC.

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: SCS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold SCS LLC, its operators owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. SCS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled, or is available from public sources and SCS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead SCS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. SCS LLC is compliant with the Can Spam Act of 2003. SCS LLC does not offer such advice or analysis, and SCS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries and extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur. Understand there is no guarantee past performance will be indicative of future results.

In preparing this publication, SCS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, SCS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. SCS LLC is not responsible for any claims made by the companies advertised herein, nor is SCS LLC responsible for any other promotional firm, its program or its structure.

SCS LLC is not affiliated with any exchange, electronic quotation system, the Securities Exchange Commission or FINRA. SCS LLC is not a Broker/Dealer and does not engage in high frequency trading.