NOTE*** (NASDAQ: DDAY) is our new profile this week

See DDAY feature article below:

(NASDAQ: DDAY) JOINT VENTURE – Flying under the radar

Joint Venture– news out April 1st, 2016 flying under the radar

NEW YORK, April 1, 2016 /PRNewswire/ — DraftDay Gaming Group, Inc., the award-winning daily fantasy sports platform, is proud to announce the launch of Draftstars, the premier Australian daily fantasy sports site.

Draftstars (draftstars.com.au), a recently announced joint venture between CrownBet and Fox Sports Australia, has launched the most advanced daily fantasy sports site in Australia, offering Australia’s biggest fantasy sports prize pools. Draftstars will also be the Official Daily Fantasy Sports Partner of the Australian Football League (AFL), with exclusive access to match content not available to any other operator.

Draftstars is built on the DraftDay™ platform developed and supplied by DraftDay Gaming Group, Inc. The DraftDay™ platform is recognized as the world’s leading B2B daily fantasy software platform. The exclusive partnership between DraftDay Gaming Group, Inc. and Draftstars in Australia is the first of many international opportunities that DraftDay has in development.

“DraftDay is excited to be partnering with Draftstars to launch the defining daily fantasy sports website in Australia,” said DraftDay’s CEO Rich Roberts. “DraftDay’s award-winning platform and B2B expertise will provide Draftstars with a market-leading daily fantasy sports technology platform, incorporating essential consumer-protection tools to enhance the player experience and increase brand loyalty.”

Kicking off with AFL as the first sporting code on the Draftstars platform, other local and global sports, including the National Rugby League (NRL) and NBA, will be added in the coming months.

Draftstars Chief Executive Officer, Matt Sanders, said, “As Australians, we love our sport, we love to compete and we love to test our knowledge of sports against our mates. Anyone who lives and breathes AFL will love Draftstars for the exciting and engaging digital sporting experience our platform will deliver. Draftstars, built on the DraftDay™ platform, is a game-changing product, which offers Draftstars players a range of contests to suit everyone, from the sports fanatic to the beginner.

About Broad Street Alerts:

Big opportunities in Small Cap’s

Broad Street Alerts recent profiles and track record, 217% in verifiable potential gains for our members on the last 4 small cap alerts alone!

February 10th, 2016- (NASDAQ: BONT) opened $1.65/share hit a high of $3.00/share within 30 days our member potential gains- 83%

March 7th, 2016-(NYSE-MKT: FSI) opened at .91/share and hit 1.10/share within 5 days for gains of 21% for our members.

March 24th, 2016- (NASDAQ: ICLD) opened at $.77/share it a high of $1.15/share within 2 days for gains of 49% for our members.

April 11th, 2016 – (NASDAQ: FNJN) called at $1.07/share hit $1.76/share in 3 days for 64% gains for our members.

These are numbers that make traders drool. Any trader in any market would fall all over themselves to see numbers like this. So if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP SMS/text alert service for free, simply text the word “Alerts” to the phone number 25827 from your cell phone.

Report on: (NASDAQ: DDAY)

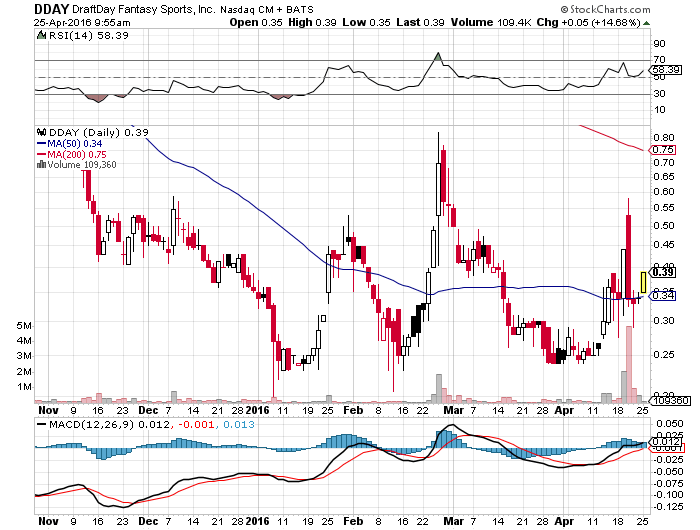

Shares of DraftDay Fantasy Sports Inc (NASDAQ:DDAY) have been weak ever since the company received its delisting notice from NASDAQ last month. We at Insider Financial are familiar with DraftDay as it was a big winner for us and our subscribers in February. We caught the explosive move higher. Now, we’re asking if DDAY can do it again.

DraftDay Fantasy Sports Inc is the largest shareholder of DraftDay Gaming Group, with a 44% stake. Sportech owns 35%. The company hopes that by combining and capitalizing on the well-established operational business assets of DraftDay and Sportech, the new DraftDay is well-positioned to become a significant player in the explosive fantasy sports market. DraftDay has paid out over $30 million in prizes with increased player retention and brand loyalty. DraftDay Fantasy Sports also operates MyGuy and Viggle Football both of which offer real-time interactive participation with professional and college football games; Wetpaint, which offers entertainment and celebrity news; and Choose Digital, a digital marketplace platform that allows companies to incorporate digital content into existing rewards and loyalty programs in support of marketing and sales initiatives.

On March 1, DDAY announced that it received a letter from the Listing Qualifications Department of The NASDAQ Stock Market (“NASDAQ”) notifying the Company that NASDAQ had determined the Company is unlikely to achieve near-term compliance with certain listing requirements relating to minimum stockholders’ equity and timely filing of quarterly reports. DDAY said that it intends to appeal this decision by requesting a hearing before a NASDAQ Listing Qualifications Panel to review NASDAQ’s decision to delist the Company. A hearing request by the Company automatically postpones the delisting of the Company’s securities pending issuance of the Panel’s decision.

IBISWorld estimates that revenue for the fantasy sports market has grown at an annual rate of 10.8 percent to $2.0 billion from 2010 to 2015. DraftDay will have a differentiated platform in the industry. The company plans to focus on B2B partnerships, including new ventures with companies.

The company just closed the sale of a number of assets, including the Viggle applications and rewards program, for stock in Perk.com, a leading cloud-based mobile rewards platform provider based in Austin, Texas. Perk.com trades on the Toronto exchange under the symbol PER.TO. Perk is a mobile-centric rewards platform targeting the “New Consumer” and rewarding people for their everyday mobile and internet activities.

Perk.com is paying in $4.7 million worth in shares along with a $1 million advance, subject to some performance conditions; DraftDay will get two warrants to purchase a total 2 million Perk.com shares. DraftDay CEO Robert Sillerman says if earnouts are achieved and warrants become exercisable, DraftDay will have received about $75 million in consideration.

We said in our original article that the most controversial aspect to DDAY is Chairman and CEO Robert F.X. Sillerman. He was once on the Forbes 400 after selling SFX Entertainment to Clear Channel in 2000 for $4.4 billion. He refounded SFX Entertainment in 2012 as a promoter of electronic dance music festivals only to see SFX Entertainment fall into bankruptcy earlier this month. Shareholders are very upset with Mr. Sillerman and many blame him for the company’s failure.

dday 4.18

Currently trading with just an $11 million market cap, DraftDay Fantasy Sports is the third-largest operator in the daily fantasy sports industry and the only publicly traded name in this fast-growing space. With the NFL season around the corner, we believe this will get investors interested in this underfollowed company and cheap way to play on the growth of the fantasy sports business.

In regards to Mr. Sillerman, we trust that he’s learned from past mistakes and sees DDAY as an opportunity to vindicate himself with investors. Due to the excitement surrounding fantasy sports, we can easily see DDAY making a strong comeback.

Source: Insider Financial