See feature articles below: (NASDAQ: MATR)

About Broad Street Alerts:

Big opportunities in Small Cap’s

Broad Street Alerts recent profiles and track record, 153% in verifiable potential gains for our members on the last 3 small cap alerts alone!

February 10th, 2016- (NASDAQ: BONT) opened $1.65/share hit a high of $3.00/share within 30 days our member potential gains- 83%

March 7th, 2016-(NYSE-MKT: FSI) opened at .91/share and hit 1.10/share within 5 days for gains of 21% for our members.

March 24th, 2016- (NASDAQ: ICLD) opened at $.77/share it a high of $1.15/share within 2 days for gains of 49% for our members.

These are numbers that make traders drool. Any trader in any market would fall all over themselves to see numbers like this. So if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP SMS/text alert service for free, simply text the word “Alerts” to the phone number 25827 from your cell phone.

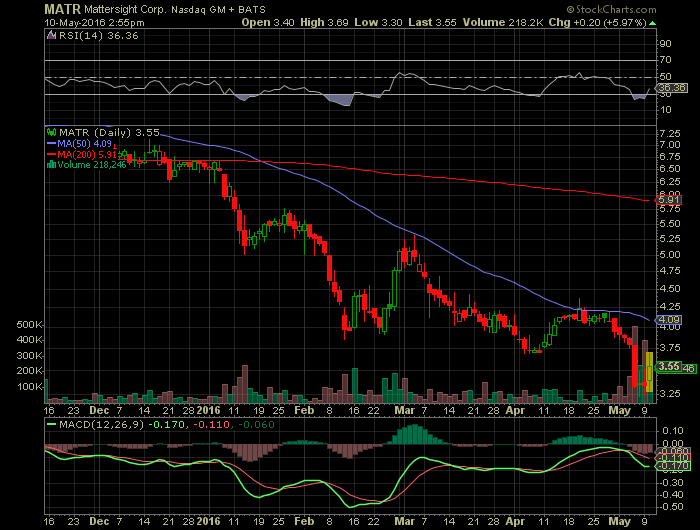

Article for: NASDAQ: MATR

Micheal John Murray, a director of MATR purchased 100,000 shares on May 9th at 3.45 per share. The purchase bring his total number of shares to 563.553. MATR shares have declined all year and this large purchase by a Director could be an indication the the share price has bottomed out.

Mattersight Corporation provides behavioral analytics services in the United States. The company provides predictive behavioral routing, performance management, quality assurance, predictive analytics, and marketing managed services that analyzes and predicts customer behavior based on the language exchanged between agents and customers during brand interactions to enhance customer satisfaction and retention, employee engagement, and operating efficiency. It serves companies in the healthcare, insurance, financial service, technology, telecommunication, cable, utility, education, hospitality, and government industries

The discussion below was excerpted from a transcript of the MATR earnings conference call on May 4th, 2016.

——————————————————————————–

Great. Before we get into the details of the call, I’d like to first review our mission and just to remind everybody what we’re doing here.

Our mission is to dominate the emerging category for personality-based applications, and this is truly a massive opportunity. It’s an opportunity of at least $10 billion a year that’s emerging.

And I’d like to make one point, which I believe is the most important point on this whole call: we are winning. We are making great progress against this mission. And I’d like to outline some of the points that put tangible meat on those bones.

In the context of this mission, I’m extremely pleased with the progress we made in Q1. Our progress has never been better. However, in the context of our short-term performance against our plan, I’m somewhat disappointed. And let me dive into some of those details.

First of all, in terms of the overall positives, it is clear that the market tailwinds for applications are increasing and increasing on a daily basis. The concept of creating strong connections using the concepts like personality, emotion, or empathy are in their early days, but the interest in these applications is clearly starting to explode.

As you know, the industry analysts — places like Gartner, Forrester, Temkin, others — are touting these ideas as the next big thing in CRM. But rather than quoting them, I prefer to cite a more tangible and perhaps an unlikely source. That source is a very large HMO who is our largest client and who is one of the country’s largest companies.

And they’re unusual because you wouldn’t think of an HMO putting so much emphasis on the ideas of emotion, empathy, and connection, but they do. For this customer, the idea of improving, what they call, consumer engagement and compassion has become a critical strategic initiative coming from the top down from the executive suite.

And this idea is opening up a number of new opportunities for us, which we believe can significantly expand this account.

Beyond these market tailwinds, I’m very pleased that in Q1 we continue to achieve record bookings, as measured by our rolling four quarter bookings, which were up 47% year over year, and a record book of business. In addition, we have the strongest sales pipeline we ever have — and I’ll get into details of that in several slides — and that strong sales pipeline is driven by activities of new sales people as well as interest in our new products, including PBR and Workstyle.

Net-net, we are extremely well positioned to both attack and capture this massive opportunity that’s sitting in front of us.

At the same time, it’s important that we need to point out and be honest about that we’re experiencing some growing pains. And those growing pains stem from the fact that we’ve had a significant influence of new contracts and new customers and, specifically, in Q1, that our revenues were about $700,000 below our internal forecast.

The lower revenues were driven by two factors: several of our large accounts having seasonably fewer users than we had planned, and slightly lower new deployment revenues from our already sold contracts.

While this is an important issue and we are attacking it, the most important thing is our overall outlook and how positive it is. The product market fit, our competitive position, the opportunities for expanding our major accounts, our new logo activity, and our overall pipeline — all of these factors, in taking them either individually or in total, our outlook has never been better.

Now, let me make a few comments relating to our financial goals for 2016. As we look out towards the end of the year, we currently expect to exit Q4 with revenues and EBITDA in line with the current analyst consensus estimates. In addition, given the momentum that we expect to build throughout the year and have at the end of the year, we remain comfortable with the current analyst consensus estimates for 2017, for both revenues and EBITDA.

David, let me now go through a few highlights of the quarter. In terms of bookings and book of business, we booked $5.4 million of new ACV in the quarter, giving us a record of $25.1 million of rolling four quarter ACV, up 47% on a rolling four quarter basis.

We signed two new logos which were both from routing. We signed a resell agreement with a very, very large consulting and SI firm. Importantly, approximately 80% of our new bookings came from new quota carriers or new accounts. And as I mentioned, we have again a new record for book of business.

We had several other highlights, as well. We signed a partnership agreement with Voci, which will allow us to provide even more advanced analytics, and we executed a new debt agreement with Silicon Valley Bank, enabling us to have the additional liquidity and financial flexibility.

I’d now like to talk about the growth levers that we see emerging and a discussion of our current pipeline.

The first growth lever is routing. Routing is driving shorter sales cycles with new logos, and we continue to have very high hit rates when we get our PBR technology installed in an account, in the range of 80% to 90% win rate. In addition, we’ve already closed one new logo this quarter at a major BlueCross plan that was PBR driven, and we are actively working on several others, as we speak.

The second major lever is the significant opportunities we see to expand our major existing accounts. Our total account opportunity is again at a record high and is increasing. In addition, we expect to reevaluate our total account opportunity in Q2 to reflect the new opportunities that emerge in several large accounts, driven by products like Workstyle and others.

When you take all of that into account, our penetration is very low at these accounts, and we see at least $20 million worth of expansion opportunities in the next four to six quarters at these accounts.

The third growth lever is the emerging partnership with this very large SI, and let me give you some details. We signed a reseller agreement with them in the first quarter. And separately, pursuant to that agreement, they signed an option that gives them the right to buy up to 15,000 routing seats from us for resale between now and the end of 2017.

That is clearly very exciting. It’s very exciting for a number of reasons. First, and perhaps most importantly, the validation of the importance of our product and the interest that our product, particularly PBR, has in this firm’s major accounts.

At a more tactical level, we are actively working several opportunities to begin to place those routing seats for which they purchased the option.

In addition, this firm has actively begun to introduce us to a number of their largest financial service and insurance clients at levels and in accounts that we would have very difficult time accessing given our limited sales resources.

Let me also talk about the pipeline. We have a very significant pipeline, as I said, the sum of it — our new logo activity, our expansion of major accounts, and the activities coming from our new reseller pipeline — has let us build the largest pipeline ever. Let me provide you some details.

On a year over — it is our largest dollar pipeline ever as we enter the second quarter. Our pipeline is up 29% year over year. We have the largest total number of deals in that pipeline in pursuit. We have the largest number of large deals, which are deals over $750,000 of ACV. And we have by far the largest new logos in pursuit. So, all of those are very encouraging.

Before I turn the call over to David to go into more details on the quarter, I also want to underscore that our model is working, and it’s working on the two most important dimensions: we are expanding large accounts and we’re adding new logos.

If you look on the graph on slide 6, you can see the trajectory of our book of business at our two largest accounts, which when you look at over a two-year period, that book of business at those two accounts has roughly gone from $11 million to about $25 million in those two accounts over the last two years, and you can see that in total it’s less than 35% penetrated. So, that is extremely exciting.

When we execute our model, which is driven by strong — getting into an account, building a beachhead, strong account management, and upselling our solutions, we have significant upside at these large accounts. That’s very encouraging. We need to execute that model day in and day out.

And in addition, we have really started to generate much more consistent activity with new logos. Over the last four quarters, we’ve added nine new logos. Those new logos have added over $15 million of new ACV bookings and created $150 million in new total account opportunity.

Those things are extremely encouraging to me and reinforce the fact that our outlook has never been better.

Having said that, I’m going to turn the call over to David to go through some of the highlights for the quarter.

——————————————————————————–

Great. Thanks, Kelly.

Before I jump into the specific highlights for Q1, I want to provide some context into the impact of our revenues in deployment. We’ve talked quite a bit on the last call and in previous calls about our revenue in deployment. This revenue is signed, contracted revenue with clients that has not been turned on yet; it has not yet been deployed into revenue.

As Kelly mentioned, we have lower than expected new revenue deployed in the quarter. As a result, we did come in about $700,000 lower than was planned in Q1, partly due to the seasonality, as Kelly mentioned, partly due to the revenue deployed.

What this slide shows is what will happen when all that revenue is deployed. So, the first column here shows our revenue, the cost associated with that revenue, our other costs, and our EBITDA as were reported for Q1. The next column then shows the impact that would occur if in Q1 all of our revenue in deployment had been turned on and was deployed.

So, we had about — just under $4.5 million of quarterly revenue that was our revenue in deployment for the quarter. If that had gone live, it would be about $14.5 million of quarterly revenue.

Kind of really importantly, that revenue in deployment is very high-margin revenue. We estimate when that goes live, it will have roughly 90% incremental gross margins for that revenue in deployment.

There are two reasons why that gross margin is quite a bit higher for the new revenue than the existing revenue. One, there are significant add-ons at our existing accounts and, in general, those add-ons at accounts carry very high incremental margins.

And the second reasons is there’s a lot of revenues being deployed that is new logo revenue that is starting with PBR. And as we discussed, PBR revenue in general is significantly higher margin revenue, as well.

So, the margin of that revenue in deployment is roughly 90%.

In addition, we do have some expense for sales related to that revenue, around commissions and other expenses. So, net-net, we have $4.5 million of quarterly revenues that is sitting in that revenue undeployed that has about around $900,000 of expense associated with that. So, there’s $3.6 million of adjusted EBITDA that is sitting in that revenue in deployment.

So, if we were to turn all that revenue on today, you can see what Q1 would have looked like, on the far-right side here. We immediately jump to $14.5 million of quarterly revenue, 75% gross margin, and adjusted EBITDA of around $1 million of positive EBITDA.

So, I wanted to provide that context as we go into the rest of the results for Q1 to show what we know is coming in our financial model as we start to deploy all this revenue that is signed and contracted and in deployment right now.

With that, I want to dive into our Q1 results summary. So, as Kelly mentioned, our bookings, our annual contract value bookings, for the first quarter was $5.4 million. As a reminder, the way we think about ACV is it is truly incremental. Our ACV bookings numbers do not include renewals of existing contracts; it is purely new incremental bookings.

Those ACV bookings, again as Kelly referenced, for the last four quarters were $25.4 million (sic – see press release, “$25.1 million”), which is up 47% year over year.

Our book of business is our revenue plus our revenue in deployment. And the annualized book of business is $58.2 million for the first quarter. It’s actually what I just showed you on the previous slide and a way to think of book of business.

So, book of business is the current revenue we have plus the sold, contracted revenue that is in deployment. If all of that was deployed, we would have been at $14.5 million, roughly, and change, which annualized is the $58.2 million for the first quarter.

Now, that’s a 28% year-over-year increase. So, that is really the breadth and scale of the business based off revenue plus revenue that is in deployment.

The revenues for the first quarter, total revenues were $10.1 million, an 8% year-over-year increase, with subscription revenues of 9.2% (sic – see press release, “$9.2 million”), which is an 11% year-over-year increase.

The adjusted EBITDA for Q1 was a loss of $2.6 million, and our gross margin was roughly 68% for Q1.

Next, I want to provide more context in that bookings trend, which is the first part of the results we just walked through.

This shows a three-year trend of our rolling four quarters bookings. We ended Q1 at $25.1 million of rolling four quarters ACV bookings, which is up 47% over the $17.1 million in Q1 of last year. If you go all the way back to Q1 of three years ago, we’re roughly four times where we were at that point. At that point, our rolling four quarters bookings was $6.5 million.

So, you can see, really, the impacts of, frankly, PBR and routing on our sales process, the impacts of being able to really expand it at the accounts, and the impacts as we’ve continued to grow and scale our sales and marketing function, the impacts that that investment has had on the business and had on our ACV bookings.

The next chart is our revenue in deployment. So, if we look at the slide we walked through before around what happens when our revenue in deployment gets deployed, that is that $17.9 million of annualized revenue, which is the roughly $4.5 million of quarterly revenue that is contracted but has not been deployed yet.

And you can see the trend of our annualized revenue in deployment. There’s a big chunk of this that is positive, in terms of our ability to sell into new logos and grow our bookings. As our bookings grows, our revenue in deployment will continue to grow, as well. It has grown at a bit higher rates than it has historically grown and that we would expect to grow in the future, and we do have a bit more revenue in deployment that is taking longer than historical to deploy.

And the impact of that, I did show on the previous slide when that will deploy. A little context I want to provide. Really, in almost every case, the delays in deploying some of this revenue are not related to our technology or our ability to deploy; they are primarily related to our clients.

And there are two reasons for those delays. One, some of these are very large new logos where it is our first engagement with them. It generally takes longer to deploy a very large initial new logo than an add-on at an existing logo or than a deployment at a smaller new logo. So, that is one reason for the delay, just there’s more processes and more groups involved at those very large new logos.

The second is related to higher end user counts. We have a number of orders in our bookings that are for expansions at our existing clients. Those seats are coming. We are actually deployed and turned on at those logos, and they are currently hiring people to fill those seats.

So, it is deployed. There is not any technology issues around deployment. It is purely around the hiring of their agent population to fill those seats and to fill those contracts and get that revenue deployed and recognized on our part.

But the other positive side of this chart is there is a huge impact coming from a P&L perspective when that $17.9 million of revenue in deployment gets turned on and gets deployed.

With that, I want to go to our book of business trends. This is our revenue. So, the blue (technical difficulty) annualized revenue. The red bar here is the slide we just looked at. It is our revenue in deployment. The revenue plus our revenue in deployment equates to our annualized book of business.

And as you can see here, we’ve had a continued steady growth quarter over quarter of our annualized book of business growing, and we ended Q1 with a $58.2 million annualized book of business.

The next chart is our subscription revenue trend, our annualized subscription revenue trend. You can see, as Kelly mentioned, we came a bit under on Q1 relative to the plan, due to higher than expected seasonality and some slower deployment of our revenue.

And the same thing equates to the total revenue trend that you see on the next slide, which is our subscription revenue plus our other revenue, [getting to the] point of an annualized total revenue basis of $40.2 million in Q1.

The next slide is our total account opportunity, which Kelly discussed on a prior slide, as well, and how we really think about that with our existing clients and logos. What this is is if we were to deploy our solution suite to all of the seats at our existing logos, what our annualized revenue would be. And you can see here we ended Q1 with a total opportunity of $368 million of recurring revenue if we sold to every seat at our existing client base. We are currently 16% penetrated our existing client base.

This chart shows two things. One, as you see that the blue bar of our total account opportunity growing quarter over quarter, that is really demonstrating the success of our hunter team and their ability to land new logos. And when we add a new logo, it adds total account opportunity to this chart.

It also shows the massive opportunity for our farmer team to expand those new logos once they are up and turned over to our farmer team. So, at 16% penetration, there’s a huge amount of opportunity to continue to grow that existing base. And as Kelly mentioned on a previous slide, we expect $20 million-plus of additional add-on orders within this total account opportunity over the next four to six quarters.

That concludes the recap of the Q1 financials. I do also want to cover our new Silicon Valley Bank agreement that occurred at the very end of Q1.

As a background, EBITDA positive is in sight, as Kelly mentioned, later this year. In the current environment, we would prefer to use debt to finance the ramp of our business versus equity, given where the equity markets are.

So, what we did is we went to Silicon Valley Bank and we did a couple of things. One, we did have a line of credit tied to our monthly recurring revenue. That line of credit had a year left on it. We extended that to another year. So, we now have a two-year line of credit on our monthly recurring line.

That equates to — it’s 3x of our monthly recurring revenues, up to $15 million. The interest rate is prime plus 1.25%.

We also added on to that line a $6 million term debt, which is interest rate of prime plus 1.5%, and that carries a four-year term.

So, this really allows us to finance our business through debt versus equity with our Silicon Valley Bank agreement and allows us to extend the term of the line of credit that we had previously with Silicon Valley.

And with that, I’m going to turn it over to Kelly for a summary of the call and our Q1.

——————————————————————————–

Kelly Conway, Mattersight Corporation – President and CEO [6]

——————————————————————————–

Great. Thank you, David. Clearly, we are making progress against a massive market opportunity that’s emerging. We are very confident in our product suite, with behavioral analytics, PBR, WorkStyle, and other advanced analytics. We truly have an impressive and differentiated product suite. It’s driving more and better and richer dialogues to land and expand accounts and, of course, we talked about the tailwinds.

There is significant evidence that it’s really working. Our bookings on a rolling four quarter basis, which is how that we measure them, are up 47%.

We have a record book of business. The book of business at our two largest accounts increased by 138% over the last two years. We’ve landed nine new logos in the last four quarters, which added $15 million in bookings and $140 million-plus in new account opportunity.

As we mentioned, as we go into Q2 we have our largest, deepest, broadest pipeline that we’ve ever had. And we’re very pleased with this new consulting partnership with this large consulting and SI firm. It’s very promising and obviously a significant validation.

Having said that, we are having some growing pains. Slow deployments have hurt our revenue ramp, and we’ve been playing catchup on the size and volume of the new deals that we bought in in terms of how we manage them and how we manage our customers.

We have done a lot to try to get ahead of that, and I think we’ve made great progress. First of all, a little over a year ago we separated our sales team into a hunter team and a farmer team. Frank Suljic, who came on to run our farmer team (i.e., the account managers), has taken that team from three to nine when he started in June. We’ve also added five hunters to accelerate a new logo traction.

And that is key, that we both manage our existing accounts and make sure that we get our account contracts booked but get them into deployed, as well as the new logo activity which, over the long run, is the key lever for our business.

In the near term, what we’re focused on is continuing our booking momentums, ramping up the deployment of already signed contracts, and, from a financial management perspective, we expect to hold our overall expenses roughly flat while we let our revenues catch up over the next several quarters, so that we get to EBITDA positive later in the year.

And finally, our goals for 2016 is we look by Q4 to exit at about the rate of revenues and EBITDA that is the analyst consensus estimates. We expect to end 2016 with $70 million-plus of book of business, and we remain comfortable with the analyst consensus estimates for 2017.

Broad street alerts has not been compensated for the mention of any publicly traded companies in this article nor do we own positions in any of the companies in this article.