See feature report below: (Nasdaq:DRWI)

About Broad Street Alerts:

Big opportunities in Small Cap’s

Broad Street Alerts recent profiles and track record, 217% in verifiable potential gains for our members on the last 4 small cap alerts alone!

February 10th, 2016- (NASDAQ: BONT) opened $1.65/share hit a high of $3.00/share within 30 days our member potential gains- 83%

March 7th, 2016-(NYSE-MKT: FSI) opened at .91/share and hit 1.10/share within 5 days for gains of 21% for our members.

March 24th, 2016- (NASDAQ: ICLD) opened at $.77/share it a high of $1.15/share within 2 days for gains of 49% for our members.

These are numbers that make traders drool. Any trader in any market would fall all over themselves to see numbers like this. So if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP SMS/text alert service for free, simply text the word “Alerts” to the phone number 25827 from your cell phone.

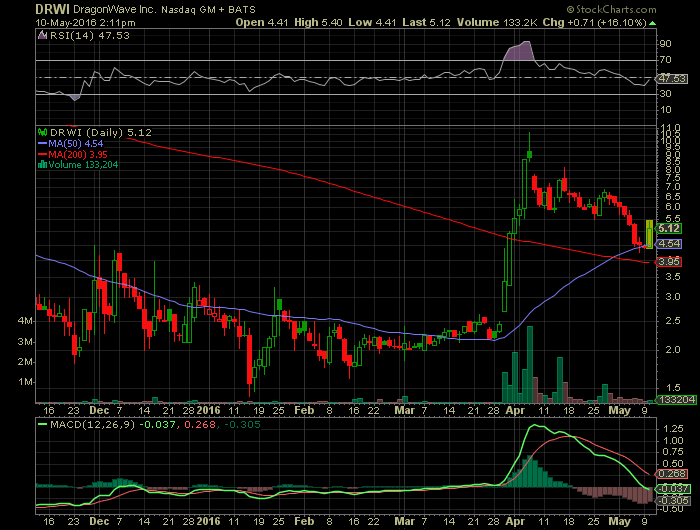

Report on : (Nasdaq:DRWI)

DragonWave Inc (NASDAQ:DRWI) has a 52-week price target of $15.54 based on the recommendations collected by First Call. The firm’s mean EPS in the last one year was $-11.91. The analysts are now projecting earnings of $0.00 for upcoming quarter and $-0.40 for ongoing year. EPS target for the next year is $-3.50.

Valuation Estimates

DragonWave Inc (NASDAQ:DRWI)P/E ratio stands at N/A. The price-EPS estimate for the next fiscal stands at N/A, and for the current year stands at N/A.On the surface, P/E ratio is a very informative and simple ratio — a firm’s stock price divided by its last twelve months of EPS. So, if a firm earned $4 per share in last twelve months and its current stock price is $40, its P/E ratio is $40 / $4 = 10. Market or analysts would say it as the stock has a multiple of 10 as it sounds so cool. The reason being investors want more earnings per dollar they invest, a lower P/E is stated more lucrative. After all, investors would rather be paying less per share for stock’s $4 in earnings. The same concept also applies when analysing different businesses, when they are equal in other respects.

This P/E ratio is just a number and only because it is low or high does not offer much intuition by itself. However, when investors compare these P/E ratios between industries and companies, they start getting the clear picture for the particular firm they are evaluating. It doesn’t much sense to evaluate P/E Ratios of firms across different industries, as industries have their unique method of conducting business.

Press Release From- DragonWave Inc

DragonWave Inc (NASDAQ:DRWI) PEG ratio for next 3-5 years stands at 0.00. With a book value of $3.79 the price-to-book ratio of the company is 1.16, and price-to-sales ratio is 0.11.

DragonWave Inc. to Announce Fourth Quarter and Full Fiscal Year 2016 Results on May 18, 2016

OTTAWA, CANADA–(Marketwired – April 26, 2016) – DragonWave Inc. (TSX:DWI)(NASDAQ:DRWI) a leading global supplier of packet microwave radio systems for mobile and access networks, today announced that it will report its fourth quarter and full fiscal year 2016 results after the close of markets in North America on May 18, 2016. The company will discuss the results on a conference call and webcast on May 19, 2016 beginning at 8:30 a.m. Eastern Time.

Webcast and Conference Call Details:

Toll-free North America Dial-in: (877) 312-9202

International Dial-in: (408) 774-4000

The live webcast and presentation slides will be available at http://investor.dragonwaveinc.com/events.cfm.

An archive of the webcast will be available at the same link.

About DragonWave

DragonWave(R) is a leading provider of high-capacity packet microwave solutions that drive next-generation IP networks. DragonWave’s carrier-grade point-to-point packet microwave systems transmit broadband voice, video and data, enabling service providers, government agencies, enterprises and other organizations to meet their increasing bandwidth requirements rapidly and affordably. The principal application of DragonWave’s portfolio is wireless network backhaul, including a range of products ideally suited to support the emergence of underlying small cell networks. Additional solutions include leased line replacement, last mile fiber extension and enterprise networks. DragonWave’s corporate headquarters is located in Ottawa, Ontario, with sales locations in Europe, Asia, the Middle East and North America. For more information, visit http://www.dragonwaveinc.com.

DragonWave(R), Horizon(R) and Avenue(R) are registered trademarks of DragonWave Inc.

Forward-Looking Statements

Certain statements in this release constitute forward-looking statements within the meaning of applicable securities laws. Forward-looking statements include statements as to DragonWave’s growth opportunities and the potential benefits of, and demand for, DragonWave’s products. These statements are subject to certain assumptions, risks and uncertainties, including our view of the relative position of DragonWave’s products compared to competitive offerings in the industry. Readers are cautioned not to place undue reliance on such statements. DragonWave’s actual results, performance, achievements and developments may differ materially from the results, performance, achievements or developments expressed or implied by such statements. Risk factors that may cause the actual results, performance, achievements or developments of DragonWave to differ materially from the results, performance, achievements or developments expressed or implied by such statements can be found in the public documents filed by DragonWave with U.S. and Canadian securities regulatory authorities. DragonWave assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by law.

FOR FURTHER INFORMATION PLEASE CONTACT:

Investor Contact:

Peter Allen

President & CEO

DragonWave Inc.

Investor@dragonwaveinc.com

613-599-9991 ext 2222

Source: DragonWave inc., Vanguard Tribune, & ACAD Charts

Broad street alerts has not been compensated for the mention of any publicly traded companies in this article nor do we own positions in any of the companies in this article.