About Broad Street Alerts:

Big opportunities in Small Cap’s in a down market

Broadstreetalerts.com recent profiles and track record, 157% in verifiable potential gains for our members in December 2015 alone.

December 29th, 2015- (NASDAQ: INVT) opened $1.35/share hit a high midday of $2.82/share over 100% in gains for our members.

December 15th, 2015-(NYSE-MKT: XXII) opened at $1.29 hit a high of $1.54 within 3 days for gains of 19% for our members.

December 2nd, 2015- (NASDAQ: TCCO) opened at $3.25 hit a high of $4.50 within 3 days for 38% gains for our members.

These are numbers that make traders drool. Any trader in any market would fall all over themselves to see numbers like this. So if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business. We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP SMS/text alert service for free, simply text the word “Alerts” to the phone number 25827 from your cell phone.

Due Diligence Report: More Trouble for SunEdison with the TerraForm Deal

Summary:

SunEdison, Inc. (SunEdison), incorporated on October 1, 1984, is a developer and seller of photovoltaic energy solutions, an owner and operator of clean power generation assets, and a developer and manufacturer of silicon wafers. The Company operates in three segments: Solar Energy, TerraForm Power and Semiconductor Materials through SunEdison Semiconductor Ltd. (SSL). The Company owns directly or indirectly, wind and solar operating and development projects representing 1.6 Gigawatts (GW) of pipeline and backlog and development opportunities representing more than 6.4 GW of wind and solar projects.

The Company’s Solar Energy segment provides solar energy services that integrate the design, installation, financing, monitoring, operations and maintenance portions of the downstream solar market for the Company’s customers. The Company’s Solar Energy segment also owns and operates solar power plants and manufactures polysilicon and silicon wafers and subcontracts the assembly of solar modules to support the Company’s downstream solar business, as well as for sale to external customers as market conditions dictate. As of December 31, 2014, the Company interconnected over 974 solar power systems representing 2.35 GW of solar energy generating capacity. As of December 31, 2014, the Company had 467 megawatts of projects under construction and 5.1 GW in pipeline. In support of the Company’s downstream solar business, the Company’s Solar Energy segment manufactures polysilicon, silicon wafers and solar modules. Additionally, the Company’s Solar Energy segment sells solar modules to third parties.

The Company develops and constructs solar power generation assets and retains the assets on the balance sheet. These assets produce electricity that is sold to the energy consumer or utility generator. The Company’s solar energy customers fall into three categories: commercial customers, which include national retail chains and real estate property management firms; federal, state and municipal Governments, and utilities. The Company’s international business operations focus primarily in certain areas in Europe, Canada, Latin America, South Africa and India. The Company provides software applications to provide customers’ control over their assets, including software to monitor, report, and diagnose performance. The Company’s also provides data analytics and insights to understand key drivers of assets performance and offers advisory services to enhance assets performance.

The Company’s TerraForm Power segment owns and operates clean power generation assets, both developed by the Solar Energy segment and acquired through third party acquisitions that sell electricity through long-term power purchase agreements to utility, commercial, and residential customers. TerraForm Power segment focuses on the solar and wind energy segments.

The Company’s Semiconductor Materials segment includes the manufacture and sale of silicon wafers to the semiconductor industry. SSL offers wafers with a range of features, which vary in size, surface features, composition, purity levels, crystal properties and electrical properties. SSL’s monocrystalline wafers for use in semiconductor applications range in size from 100 millimeter to 300 millimeter and are round in shape for semiconductor customers. These wafers are used as the starting material for the manufacture of various types of semiconductor devices, including microprocessor, memory, logic and power devices. The Company’s monocrystalline wafers for semiconductor applications include four general categories of wafers: prime, epitaxial (EPI), test/monitor and silicon-on-insulator (SOI) wafers.

SSL’s polished wafers are used in a range of applications, including memory, analog, radio frequency (RF) devices, digital signal processors (DSPs) and power devices. SSL’s polished wafer is a polished, refined wafer with a flat surface. SSL’s OPTIA wafer is a crystalline structure based on its technologies and processes, including MDZ. SSL’s MDZ product feature draws impurities away from the surface of the wafer during device processing. The Company’s annealed wafer is a polished wafer with near surface crystalline defects dissolved during a high-temperature thermal treatment. SSL also supply’s test/monitor wafers to its customers for their use in testing semiconductor fabrication lines and processes.

SSL’s EPI wafers are used in mobile device and cloud infrastructure applications. SSL’s wafers consist of a thin silicon layer grown on the polished surface of the wafer. SSL designed its AEGIS product for certain specialized applications requiring high resistivity EPI wafers. The AEGIS wafer includes a thin epitaxial layer. SSL’s SOI wafers have three layers: a thin surface layer of silicon where the transistors are formed, an underlying layer of insulating material and a support or handle bulk semiconductor wafer. SSL sells its products to semiconductor manufacturers, including integrated device manufacturers and semiconductor foundries and to companies that specialize in wafer customization. SSL services its customers through its 13 global locations, including manufacturing plants and sales and services offices.

SunEdison, Inc. has a current market capitalization of $514.94 M with 316.94 M outstanding shares. Its daily average volume traded is 30.65 M shares.

Key Indicators (Q3 2015) Performance (6 months)

| Shares Outstanding | 316.94 M |

| Revenue | 476.0 M |

| Gross Profit | 111.0 M |

| Net Income(Basic/Diluted) | -284.0 M |

| Cash and Short-term Inv | 2393.0 M |

| Total Debt | 11672.0 M |

Recent News and Analysis:

The latest from SunEdison includes the company saying it has defeated an injunction filed by David Tepper’s Appaloosa Management on its TerraForm deal. The company on Thursday said it was “gratified” after the Court of Chancery in Delaware denied Appaloosa’s injunction to prevent SunEdison’s yield co, TerraForm Power Inc., from buying some of Vivint Solar Inc.’s assets. TerraForm is to acquire Vivint’s residential solar rooftop portfolio for $799 million after SunEdison completes the Vivint transaction. Appaloosa has repeatedly said TerraForm’s acquisition of Vivint’s assets, which had an initial purchase price of $922 million, was not in the interest of the yield co.’s shareholders, mainly because it would alter the company’s business model and force it to take on debt of $960 million.

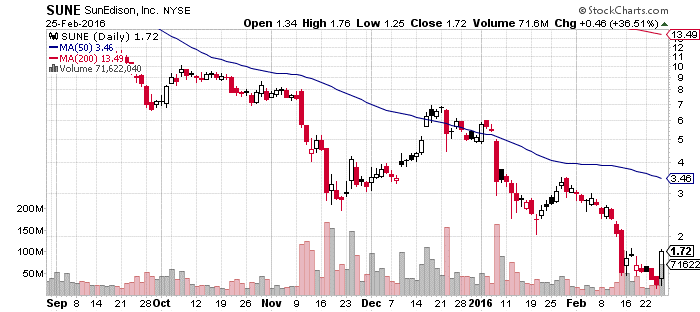

While investors are celebrating the deal, they weren’t liking it when it was announced back in July. In the chart above, you can see that while shares of SunEdison are down 92% over the last year, much of that drop occurred just as the Vivint deal was announced in July. At the time, investors felt SunEdison was biting off more than it could chew and that Vivint’s portfolio of residential projects was of inferior credit quality compared to SunEdison’s more commercial projects.

To be sure, terms of the Vivint deal were amended in December. Among the changes to the original deal, SunEdison was able to lower the cash amount it was paying to Vivint by $2 a share. While the economics were better, Appaloosa Management, which had a stake in SunEdison’s yieldco, TerraForm Power (TERP), took issue with aspects of the proposed deal that would require TerraForm Power to purchase Vivint’s projects from SunEdison. In January, Appaloosa Management filed a complaint against SunEdison alleging it “breached its fiduciary duties to TERP and its minority stockholders.” Shares of TerraForm Power closed up a more modest 2% and are down 5% in after-hours trading.

Conclusions:

Analysts on the street are not overly optimistic on SUNE. “This should clear the way for SUNE to acquire VSLR and potentially place the operating assets at TERP instead of holding the assets on their balance sheet (which is very constrained),” Patrick Jobin, an analyst at Credit Suisse, wrote in a note after the announcement. Credit Suisse has a Neutral rating on the company and a price target of $3.

Sources:

- http://stockcharts.com/h-sc/ui?s=SUNE&p=D&b=5&g=0&id=p77403776877

- https://www.google.ca/finance?q=NYSE%3ASUNE&fstype=ii&hl=en&gl=ca&ei=haHPVvm5M9PCjAGhr5XIDg

- http://www.reuters.com/finance/stocks/companyProfile?rpc=66&symbol=SUNE.K

- http://finance.yahoo.com/q?s=SUNE&ql=0

- http://finance.yahoo.com/news/sunedison-defeats-appaloosas-injunction-terraform-001945853.html

- http://realmoney.thestreet.com/articles/02/25/2016/denial-injunction-lifts-sunedison-shares?puc=yahoo&cm_ven=YAHOO

Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it, and I have no business relationship with any company whose stock is mentioned in the article. I reserve the right to sell the redistribution rights to this report for up to two hundred fifty dollars/news source.

The information contained herein is not intended to be investment advice and does not constitute any form of invitation or inducement by Robert Borowski, MSc. to engage in investment activity. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities, financial instruments, strategies, or commentary mentioned herein may not be suitable for all investors and this material is not intended for any specific investor and does not take into account an investor’s particular investment objectives, financial situations or needs. Any opinions expressed herein are given in good faith, are subject to change without notice, and are only current as of the stated date of their issue. Prices, values, or income from any securities or investments mentioned in this report may fluctuate, and an investor may, upon selling an investment lose a portion of, or the entire principal amount invested. Past performance is no guarantee of future results. Before acting on any recommendation in this material, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice.

DISCLAIMER

Broad Street Alerts has compensated the author of this report up to two hundred and fifty dollars for the redistribution rights for a period of up to 30 days.

BroadStreetAlerts.com is a wholly owned subsidiary of Small Cap Specialists LLC, herein referred to as SCS LLC.

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. We have not been compensated in any form by any entity for this report. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: SCS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold SCS LLC, its operators owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. SCS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled, or is available from public sources and SCS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead SCS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. SCS LLC is compliant with the Can Spam Act of 2003. SCS LLC does not offer such advice or analysis, and SCS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries and extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur. Understand there is no guarantee past performance will be indicative of future results.

In preparing this publication, SCS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, SCS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. SCS LLC is not responsible for any claims made by the companies advertised herein, nor is SCS LLC responsible for any other promotional firm, its program or its structure.

SCS LLC is not affiliated with any exchange, electronic quotation system, the Securities Exchange Commission or FINRA. SCS LLC is not a Broker/Dealer and does not engage in high frequency trading.