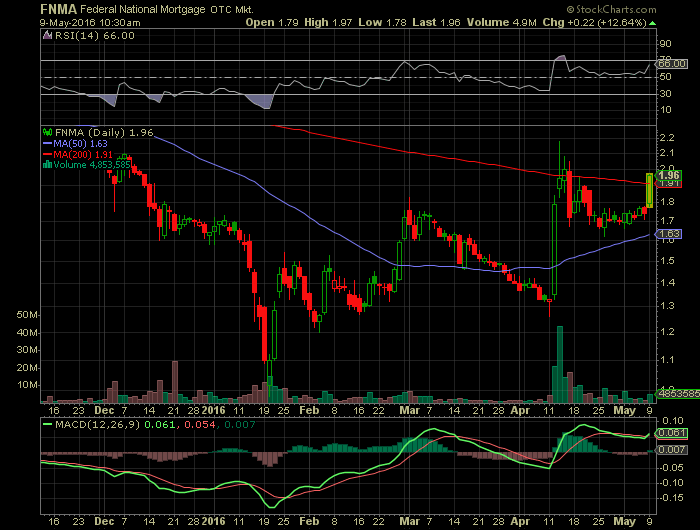

See feature articles below: (OTCMKT: FNMA)

About Broad Street Alerts:

Big opportunities in Small Cap’s

Broad Street Alerts recent profiles and track record, 217% in verifiable potential gains for our members on the last 4 small cap alerts alone!

February 10th, 2016- (NASDAQ: BONT) opened $1.65/share hit a high of $3.00/share within 30 days our member potential gains- 83%

March 7th, 2016-(NYSE-MKT: FSI) opened at .91/share and hit 1.10/share within 5 days for gains of 21% for our members.

March 24th, 2016- (NASDAQ: ICLD) opened at $.77/share it a high of $1.15/share within 2 days for gains of 49% for our members.

These are numbers that make traders drool. Any trader in any market would fall all over themselves to see numbers like this. So if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP SMS/text alert service for free, simply text the word “Alerts” to the phone number 25827 from your cell phone.

Report on : (OTCMKT: FNMA)

Fannie Mae to offer no-credit-score mortgages

There was no such animal as a credit score until about 1995. Well, it’s back to the future. Good going Fannie Mae.

On June 25, Fannie Mae will be rolling out the automation of a manual process for mortgage applicants without credit scores, according to Mindy Armstrong, senior product manager at Fannie Mae.

Here’s how it will work: A loan officer takes your application and runs your credit, but the credit bureaus Equifax, Transunion and Experian have no credit scores for you. This usually happens because you don’t have any or don’t have enough traditional credit (credit cards or auto financing, for example).

In the past, that meant that we loan officers were unable to qualify you for a loan backed by Fannie Mae. But in seven weeks, you will qualify, opening up a vast new array of borrowing options.

You are eligible for purchase as well for a no cash-out refinance loan if the lender can gather at least two pieces of credit information that covers the last 12 months. One must be a verification of rent. The other can be anything from a utility bill to on-time payments to your local gym.

You must put a minimum of 10 percent down (or have 10 percent equity when refinancing), all of which can be a gift. It has to be a single unit primary residence and, for Orange County, your loan amount cannot exceed $417,000.

Call me cynical, but I think credit scoring is just a “gotcha” way for creditors in general to upcharge borrowers that don’t have the very best credit scores.

“Thirty percent of bureau data is inaccurate,” said Stan Baldwin, chief operating officer at Garden Grove-based credit report seller Informative Research.

Where Fannie’s no-score gets ugly is the pricing. Fannie Mae is going to assume that your credit score is in its lowest allowable FICO score bucket of 620. That adds 0.625 percent to your mortgage rate for well-qualified borrowers.

“We price for the risk,” said Andrew Wilson, Fannie Mae spokesman.

Out of all seven mortgage insurance companies, so far only Radian and Arch told me they are willing to insure these loans.

Radian’s pricing looks very competitive compared to other standard mortgage insurance rates, adding 1.10 percent to your base interest rate. They also assume a 620 middle FICO score. Arch pricing was not available.

Assume you buy a $450,000 home and get a $405,000, zero-point 30-year fixed-rate mortgage at 4 percent, with a homeowner’s association fee of $350 a month. Your total payment with impounds would be about $3,159.

None of my piggy-back lenders (avoiding mortgage insurance by providing a 10 percent second behind an 80 percent first mortgage) will go behind a no-score loan. At a minimum, a 680 middle score is required.

Fannie needs to rethink their one size fits all pricing. They assume all no-score borrowers are high risk, just like the “before score” olden days.

They should consider job stability, cash reserves, and payment shock (industry jargon for how much your house payment will go up from your current rent).

Better risk borrowers deserve better pricing, score or not.

Source: The Orange County Registry & ACAD Charts

Broad street alerts has not been compensated for the mention of any publicly traded companies in this article nor do we own positions in any of the companies in this article.