About broad Street- full report below

Big opportunities in Small Cap’s

Broad Street Alerts recent profiles and track record, 153% in verifiable potential gains for our

members in the last 3 small cap alerts alone!

• February 10th, 2016- (NASDAQ: BONT) opened $1.65/share hit a high of $3.00/share within 30 days our members gains- 83%

• March 7th, 2016-(NYSE-MKT: FSI) opened at .91/share and hit 1.10/share within 5 days for gains of 21% for our members.

• March 24th, 2016- (NASDAQ: ICLD) opened at $.77/share it a high of $1.15/share within 2 days for gains of 49% for our members.

These are numbers that make traders drool. Any trader in any market would fall all over themselves to

see numbers like this. So if you’ve been on the fence, perhaps it’s time to start doing some research and

verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest

of the small-cap newsletters as the best in business. We know with a large following comes a large

responsibility as we have everyone from institutional investors to the beginner following our profiled

securities in our newsletters. This is something we take very seriously always seeking small cap growth

companies that have both near and long-term potential for our members.

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our

VIP SMS/text alert service for free, simply text the word “Alerts” to the phone number 25827 from your cell phone.

HPJ-Full Report

A number of investment brokers have recently updated their price targets on shares of Hong Kong Highpower Technology (HPJ). According to the latest broker reports outstanding on Friday 1st of April, 0 analysts have a rating of “strong buy”, 0 analysts “buy”, 0 analysts “neutral”, 0 analysts “sell” and 0 analysts “strong sell”.

Most recent broker ratings

05/03/2015 – Hong Kong Highpower Technology was downgraded to “hold” by analysts at Zacks. They now have a USD 4.75 price target on the stock.

09/29/2014 – Hong Kong Highpower Technology had its “buy” rating reiterated by analysts at H.C. Wainwright. They now have a USD 12 price target on the stock.

09/23/2014 – Ardour Capital began new coverage on Hong Kong Highpower Technology giving the company a “buy” rating. They now have a USD 15 price target on the stock.

The share price of Hong Kong Highpower Technology (HPJ) was down -4.59% during the last day of trading, with a day high of 1.95. 49699 shares were traded during the last session.

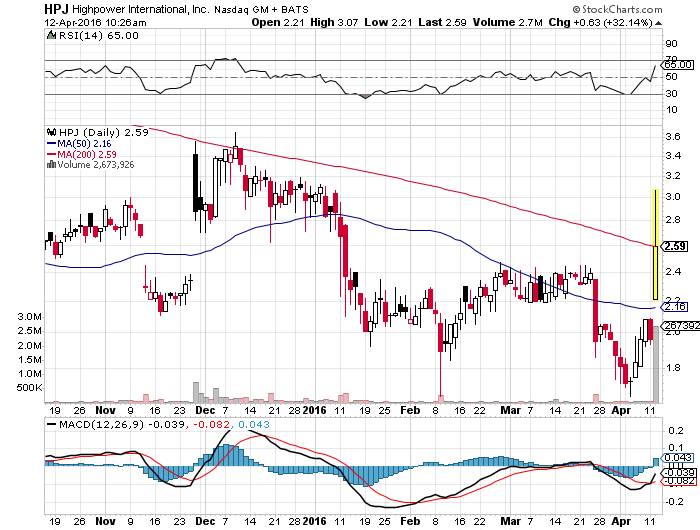

The stock’s 50 day moving average is 2.22 and its 200 day moving average is 2.51. The stock’s market capitalization is 28.24M. Hong Kong Highpower Technology has a 52-week low of 1.65 and a 52-week high of 5.00.

Highpower International, Inc. is a company, through its subsidiaries, engaged in the manufacturing and trading of nickel metal hydride rechargeable batteries. The Company manufactures Nickel Metal Hydride (Ni-MH) batteries for both consumer and industrial applications. It is engaged in research and manufacturing of batteries; processing, marketing and research of battery materials, and research and production of advanced battery packs and systems. It produces batteries falling into two main categories: Consumer Batteries, which are relative to ordinary Ni-Cad rechargeable batteries, as well as their non-rechargeable counterparts, and Industrial Batteries, which are designed for electric bikes, power tools and electric toys. The Company produces A, AA and AAA sized batteries in blister packing, as well as chargers and battery packs. It also recycles scrap battery materials through outsourcing and resells the recycled materials to some of its customers.

| Trading Information |

|---|

|

||||||||||||||||

|

||||||||||||||||||||||

Can HPJ stay above the 200 day MA?

Barchart opinion-

| Composite Indicators | Signal | ||

| Hold | |||

| Short Term Indicators | |||

| Buy | |||

| Buy | |||

| Buy | |||

| Sell | |||

| Buy | |||

| Short Term Indicators Average: 60% Buy | |||

| 20-Day Average Volume – 100,970 | |||

| Medium Term Indicators | |||

| Buy | |||

| Buy | |||

| Sell | |||

| Buy | |||

| Medium Term Indicators Average: 50% Buy | |||

| 50-Day Average Volume – 65,206 | |||

| Long Term Indicators | |||

| Buy | |||

| Buy | |||

| Sell | |||

| Long Term Indicators Average: 33% Buy | |||

| 100-Day Average Volume – 94,134 | |||

| Overall Average: 48% Buy | |||

Sources

Risers and Fallers

Yahoo Finance

Barchart

Stockcharts

Broad Street Alerts has not been compensated for this article and we do not hold any positions in the securities mentioned.