Zacks Investment Research upgraded shares of Mitel Networks Corp (NASDAQ:MITL) from a hold rating to a buy rating in a research note published on Thursday morning, Market Beat.com reports. They currently have $8.00 target price on the stock.

According to Zacks, “Mitel Networks is a provider of integrated communications solutions focused on the SME market. Its portfolio of IP-based communications solutions consists of IP telephony platforms, unified communications and collaboration applications and managed and network services. By integrating voice, video and data communications with business applications, Mitel enables businesses to improve their performance. Mitel involves in the market evolution to unified communications and collaboration, enabling customers to move beyond basic fixed telephony and disparate communications tools toward integrated multi-media communications and collaboration between users, wherever they may be located. Mitel’s U.S. headquarters are in Phoenix, Arizona. Global headquarters are in Ottawa, Canada, with offices, partners, and resellers worldwide. “

Several institutional investors recently modified their holdings of MITL. Sei Investments Co. raised its position in shares of Mitel Networks Corp by 6.9% in the fourth quarter. Sei Investments Co. now owns 328,305 shares of the company’s stock worth $2,525,000 after buying an additional 21,170 shares in the last quarter. First Interstate Bank raised its position in shares of Mitel Networks Corp by 183.4% in the fourth quarter. First Interstate Bank now owns 32,845 shares of the company’s stock worth $253,000 after buying an additional 21,255 shares in the last quarter. The Manufacturers Life Insurance Company raised its position in shares of Mitel Networks Corp by 2.9% in the fourth quarter. The Manufacturers Life Insurance Company now owns 1,423,623 shares of the company’s stock worth $10,948,000 after buying an additional 40,484 shares in the last quarter. Paradigm Capital Management Inc. NY raised its position in shares of Mitel Networks Corp by 6.5% in the fourth quarter. Paradigm Capital Management Inc. NY now owns 2,033,000 shares of the company’s stock worth $15,633,000 after buying an additional 123,700 shares in the last quarter. Finally, Swiss National Bank bought a new position in shares of Mitel Networks Corp during the fourth quarter worth $1,029,000.

Separately, CIBC reissued a sector outperform rating and issued a $12.50 price objective (down from $13.50) on shares of Mitel Networks Corp in a research note on Thursday, December 3rd.

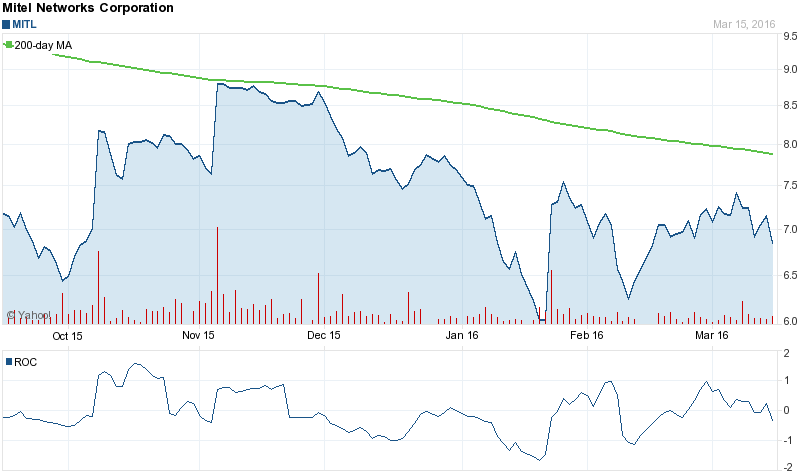

Mitel Networks Corp (NASDAQ:MITL) opened at 6.85 on Thursday. Mitel Networks Corp has a 52-week low of $5.91 and a 52-week high of $10.81. The firm has a 50 day moving average of $7.02 and a 200-day moving average of $7.46. The stock’s market cap is $824.12 million.

Mitel Networks Corp (NASDAQ:MITL) last announced its quarterly earnings data on Thursday, February 25th. The company reported $0.29 earnings per share (EPS) for the quarter, topping the Zacks’ consensus estimate of $0.28 by $0.01. During the same period last year, the company earned $0.36 earnings per share. The firm earned $335.70 million during the quarter, compared to analysts’ expectations of $332.43 million. The business’s revenue for the quarter was down .3% on a year-over-year basis. Equities analysts anticipate that Mitel Networks Corp will post $0.75 earnings per share for the current fiscal year.

Mitel Networks Corporation (NASDAQ:MITL) is a global provider of business communications and collaboration software, services and solutions. The Company operates in two segments: Premise and Cloud. The Premise segment sells and supports products and services for premise-based customers.

Source: Zolmax