See feature articles below:

About Broad Street Alerts:

Big opportunities in Small Cap’s

Broad Street Alerts recent profiles and track record, 153% in verifiable potential gains for our members on the last 3 small cap alerts alone!

February 10th, 2016- (NASDAQ: BONT) opened $1.65/share hit a high of $3.00/share within 30 days our member potential gains- 83%

March 7th, 2016-(NYSE-MKT: FSI) opened at .91/share and hit 1.10/share within 5 days for gains of 21% for our members.

March 24th, 2016- (NASDAQ: ICLD) opened at $.77/share it a high of $1.15/share within 2 days for gains of 49% for our members.

These are numbers that make traders drool. Any trader in any market would fall all over themselves to see numbers like this. So if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP SMS/text alert service for free, simply text the word “Alerts” to the phone number 25827 from your cell phone.

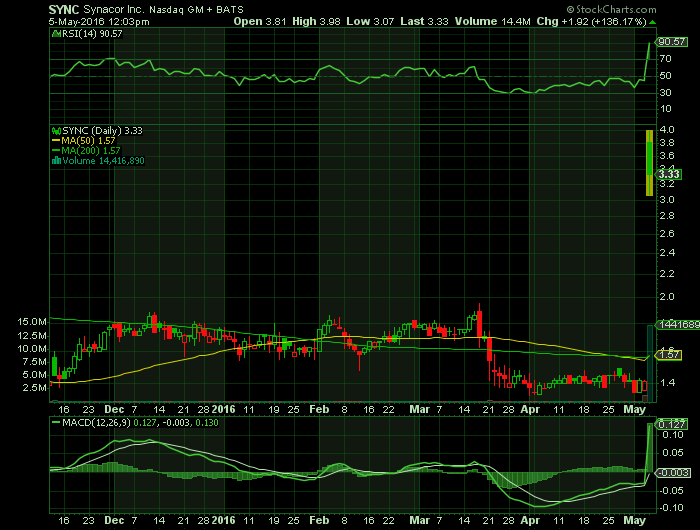

Report for: SYNC

AT&T is backing away from Yahoo and taking a $100 million deal with it.

The telecom giant is extricating itself from a 15-year deal with the troubled Sunnyvale-based Yahoo, according to the Wall Street Journal. AT&T said Wednesday that it awarded a major contract to host its Web and mobile portals to Synacor Inc., effectively shifting a major portion of AT&T’s business from Yahoo. The AT&T partnership generated about $100 million in annual revenue for Yahoo, according to Sameet Sinha, an analyst at B. Riley & Co.

“We have agreed to have Synacor manage our next-generation att.net portal, AT&T-branded applications, and search,” AT&T said in a statement. Yahoo will continue to host email for AT&T customers. A Yahoo spokeswoman called AT&T a “valued partner.”

The deal provided AT&T broadband customers with access to Yahoo’s search engine and other media services on the default AT&T website. AT&T and Yahoo split the search and display ad revenue from the site, per the report.

Synacor stock shot up more than 119 percent in after-hours trading Wednesday on news of the three-year deal. The Buffalo, N.Y.-based company posted $110.2 million in total revenue in 2015. Synacor will split the search and advertising revenue with AT&T.

The news comes at a time when one of AT&T’s biggest competitors, Verizon, is considering buying up Yahoo. Verizon is reportedly a leading contender to purchase Yahoo’s core assets within the next two months for between $4 billion to $10 billion. AT&T was also reportedly interested in buying Yahoo’s assets, but dropped out of the bidding early on.

The loss of the AT&T deal could affect how much interested buyers are willing to pay for Yahoo. The company’s revenue is expected to drop to $3.5 billion in 2016, down 15 percent from $4.1 billion in 2015 and nearly $1 billion less than the $4.4 billion it recorded in 2014, according to a report from Re/code.

Source – Silicon Valley Business Journal

Broad street alerts has not been compensated for the mention of any publicly traded companies in this article nor do we own positions in any of the companies in this article.

Stock market

Hot small cap stocks

small cap stock picks

Biotech stocks

FDA approval stocks

FDA calendar

Trade stocks

Become a day trader

Day trade stocks for a living

PDUFA date set

micro cap stocks

Best stocks 2016

Hottest small cap stocks

Best stock picks

Who to follow for stock picks

Apple news stock picks

Stock picks on apple news