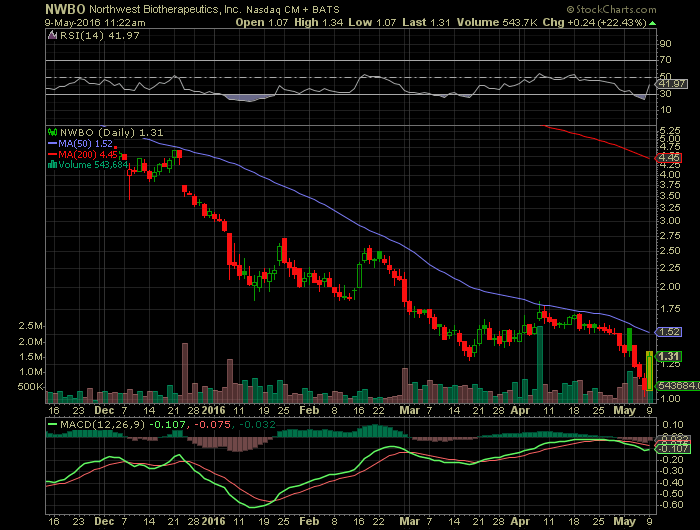

See feature articles below: (Nasdaq: NWBO)

About Broad Street Alerts:

Big opportunities in Small Cap’s

Broad Street Alerts recent profiles and track record, 217% in verifiable potential gains for our members on the last 4 small cap alerts alone!

February 10th, 2016- (NASDAQ: BONT) opened $1.65/share hit a high of $3.00/share within 30 days our member potential gains- 83%

March 7th, 2016-(NYSE-MKT: FSI) opened at .91/share and hit 1.10/share within 5 days for gains of 21% for our members.

March 24th, 2016- (NASDAQ: ICLD) opened at $.77/share it a high of $1.15/share within 2 days for gains of 49% for our members.

These are numbers that make traders drool. Any trader in any market would fall all over themselves to see numbers like this. So if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP SMS/text alert service for free, simply text the word “Alerts” to the phone number 25827 from your cell phone.

Report on : (Nasdaq: NWBO)

Northwest Biotherapeutics, Inc. (NASDAQ:NWBO) has a 52-week price target of $5.000 based on the recommendations collected by First Call. The firm’s mean EPS in the last one year was $-1.841. The analysts are now projecting earnings of $0.000 for upcoming quarter and $-1.850 for ongoing year. EPS target for the next year is $-1.600.

Valuation Estimates

Northwest Biotherapeutics, Inc. (NASDAQ:NWBO)P/E ratio stands at N/A. The price-EPS estimate for the next fiscal stands at N/A, and for the current year stands at N/A.On the surface, P/E ratio is a very informative and simple ratio — a firm’s stock price divided by its last twelve months of EPS. So, if a firm earned $4 per share in last twelve months and its current stock price is $40, its P/E ratio is $40 / $4 = 10. Market or analysts would say it as the stock has a multiple of 10 as it sounds so cool. The reason being investors want more earnings per dollar they invest, a lower P/E is stated more lucrative. After all, investors would rather be paying less per share for stock’s $4 in earnings. The same concept also applies when analysing different businesses, when they are equal in other respects.

This P/E ratio is just a number and only because it is low or high does not offer much intuition by itself. However, when investors compare these P/E ratios between industries and companies, they start getting the clear picture for the particular firm they are evaluating. It doesn’t much sense to evaluate P/E Ratios of firms across different industries, as industries have their unique method of conducting business.

Northwest Biotherapeutics, Inc. (NASDAQ:NWBO) PEG ratio for next 3-5 years stands at 0.000. With a book value of $-0.734 the price-to-book ratio of the company is N/A, and price-to-sales ratio is 56.535.

Earnings-

Northwest Biotherapeutics, Inc. is estimated to report earnings on 05/09/2016. The upcoming earnings date is derived from an algorithm based on a company’s historical reporting dates.Our vendor, Zacks Investment Research, might revise this date in the future, once the company announces the actual earnings date. According to Zacks Investment Research, based on 1 analysts’ forecasts, the consensus EPS forecast for the quarter is $-0.25. The reported EPS for the same quarter last year was $-0.34.

Read more: http://www.nasdaq.com/earnings/report/nwbo#ixzz48AjgZlJD

Source: Nasdaq, Equities Focus & ACAD Charts

Broad street alerts has not been compensated for the mention of any publicly traded companies in this article nor do we own positions in any of the companies in this article.