See feature articles below:

About Broad Street Alerts:

Big opportunities in Small Cap’s

Broad Street Alerts recent profiles and track record, 153% in verifiable potential gains for our members on the last 3 small cap alerts alone!

February 10th, 2016- (NASDAQ: BONT) opened $1.65/share hit a high of $3.00/share within 30 days our member potential gains- 83%

March 7th, 2016-(NYSE-MKT: FSI) opened at .91/share and hit 1.10/share within 5 days for gains of 21% for our members.

March 24th, 2016- (NASDAQ: ICLD) opened at $.77/share it a high of $1.15/share within 2 days for gains of 49% for our members.

These are numbers that make traders drool. Any trader in any market would fall all over themselves to see numbers like this. So if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP SMS/text alert service for free, simply text the word “Alerts” to the phone number 25827 from your cell phone.

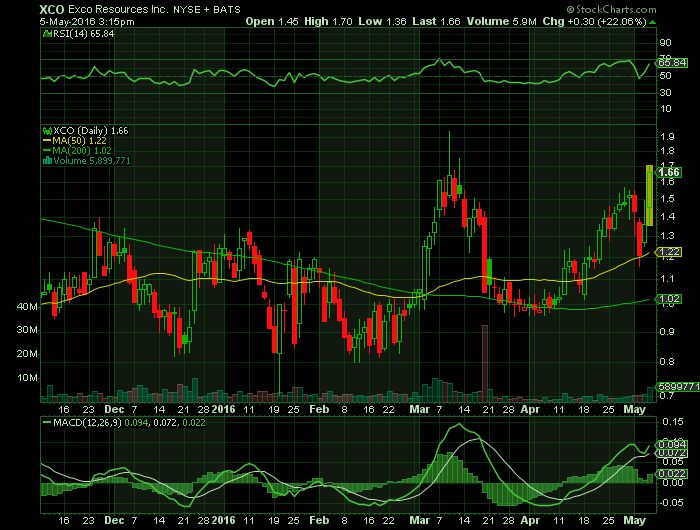

Report for: XCO

Shares of EXCO Resources (NYSE:XCO) are up 17.4% as of 10:45 a.m. ET after the company reported earnings that were better than Wall Street expectations.

Most oil and gas companies have some pretty low hurdles to jump over this quarter, and EXCO was able to do it this quarter. GAAP earnings per share came in at a loss of $0.47, but after stripping out the $134 million in asset impairments, its normalized earnings was a more palatable loss of $0.07. That was quite a bit better than the $0.12 per share that consensus analyst estimates compiled by S&P Global Market Intelligence expected.

The earnings report was also promising because it showed a company that was cutting costs, reducing capital spending, and decreasing its debt load. For the quarter, lease operating expenses and SG&A expenses declined by 25% and 27%, respectively; it announced a reduction of its 2016 capital spending budget to $85 million, a 69% drop from 2015; and it also bought back $54 million worth of senior notes for just $8 million in cash while maintaining $256 million in available liquidity through cash and short-term borrowing capacity. These are all promising signs for a company that is heavily weighed down by a sizable debt load.

The progress that EXCO Resources showed in its earnings report was commendable, but let’s still remember that it is still generating losses on the income statement and burning through cash because of cheap natural gas prices. The company has said that it wants to be the low-cost provider, and from an operational standpoint, it is getting there. However, with that large debt load hanging over it, there will be a constant drag on overall profitability. Until the company makes further inroads in whittling down that debt, it’s probably best to stay away.

Source – Motley Fool

Broad street alerts has not been compensated for the mention of any publicly traded companies in this article nor do we own positions in any of the companies in this article.

Stock market

Hot small cap stocks

small cap stock picks

Biotech stocks

FDA approval stocks

FDA calendar

Trade stocks

Become a day trader

Day trade stocks for a living

PDUFA date set

micro cap stocks

Best stocks 2016

Hottest small cap stocks

Best stock picks

Who to follow for stock picks

Apple news stock picks

Stock picks on apple news