See feature articles below: RDWR

About Broad Street Alerts:

Big opportunities in Small Cap’s

Broad Street Alerts recent profiles and track record, 153% in verifiable potential gains for our members on the last 3 small cap alerts alone!

February 10th, 2016- (NASDAQ: BONT) opened $1.65/share hit a high of $3.00/share within 30 days our member potential gains- 83%

March 7th, 2016-(NYSE-MKT: FSI) opened at .91/share and hit 1.10/share within 5 days for gains of 21% for our members.

March 24th, 2016- (NASDAQ: ICLD) opened at $.77/share it a high of $1.15/share within 2 days for gains of 49% for our members.

These are numbers that make traders drool. Any trader in any market would fall all over themselves to see numbers like this. So if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP SMS/text alert service for free, simply text the word “Alerts” to the phone number 25827 from your cell phone.

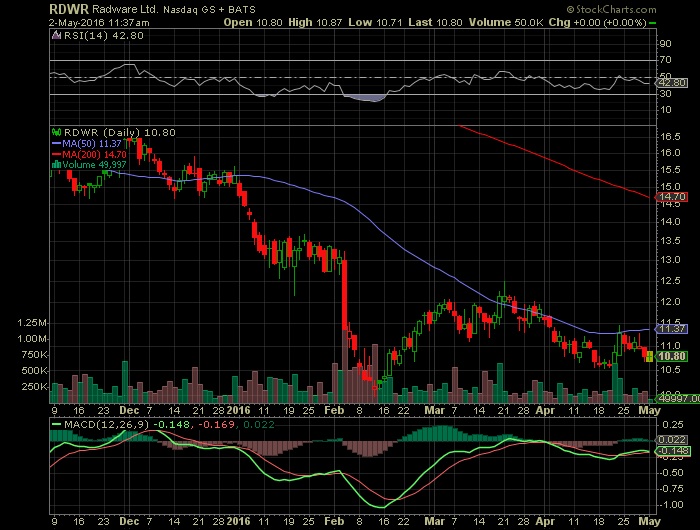

Latest Analyst Opinion- Should You Buy Radware (RDWR) Ahead of Earnings?

Latest Ratings and Article: (NASDAQ: RDWR)

They expect $0.05 EPS, down 260% or $0.13 from last year’s $0.18 per share.

At the moment 8 analysts are watching Radware Ltd. (NASDAQ:RDWR), 1 rate it “Buy”, 3 “Outperform”, 4 “Underperform”, 0 “Sell”, while 0 “Hold”.

Looking forward, for the quarter ending Jun-16, 8 analysts have a mean sales target of 51.78 million. For the quarter ending Sep-16, 7 analysts have a mean sales target of 53.91 million whilst for the year ending Dec-16, 9 analysts have a mean target of 218.00 million.

In terms of earnings per share, 8 analysts have a 0.09 EPS mean target for the quarter ending Jun-16, for the quarter ending Sep-16, 8 analysts have a 0.12 EPS mean target and for the quarter ending Sep-16 there are 8 estimates of 0.44 EPS.

The biggest institutional shareholders in Radware Ltd. include SENVEST INTERNATIONAL LLC which owns 4 million shares in the company valued at $64.63 million. Cadian Capital Management, LLC is the second biggest holder with 4 million shares currently valued at 62.47 million whilst Federated Global Inv Mgmt Corp has 2 million shares valued at 27.33 million.

Total shares held by institutions as of the most recent company filings are 29,962,993 with a reported 5,235,105 bought and 3,052,282 sold. These holdings make up 66.43% of the company’s outstanding shares.

The stock decreased 1.82% or $0.2 during the last trading session, hitting $12.65. Radware Ltd. (NASDAQ:RDWR) has fallen 20.16% over the past 6 months and is downtrending.

Latest:

That is because Radware is seeing favorable earnings estimate revision activity as of late, which is generally a precursor to an earnings beat. After all, analysts raising estimates right before earnings—with the most up-to-date information possible—is a pretty good indicator of some favorable trends underneath the surface for RDWR in this report.

In fact, the Most Accurate Estimate for the current quarter is currently at 7 cents per share for RDWR, compared to a broader Zacks Consensus Estimate of 5 cents per share. This suggests that analysts have very recently bumped up their estimates for RDWR, giving the stock a Zacks Earnings ESP of 40.00% heading into earnings season.

Why is this Important?

A positive reading for the Zacks Earnings ESP has proven to be very powerful in producing both positive surprises, and outperforming the market. Our recent 10 year backtest shows that stocks that have a positive Earnings ESP and a Zacks Rank #3 (Hold) or better show a positive surprise nearly 70% of the time, and have returned over 28% on average in annual returns (see more Top Earnings ESP stocks here).

Given that RDWR has a Zacks Rank #2 (Buy) and an ESP in positive territory, investors might want to consider this stock ahead of earnings. Clearly, recent earnings estimate revisions suggest that good things are ahead for Radware, and that a beat might be in the cards for the upcoming report.

Source: Share Trading News, Zachs, & ADCAD Charts

Broad street alerts has not been compensated for the mention of any publicly traded companies in this article nor do we own positions in any of the companies in this article.

Hot small cap stocks

small cap stock picks

Biotech stocks

FDA approval stocks

FDA calendar

Trade stocks

Become a day trader

Day trade stocks for a living

PDUFA date set

micro cap stocks

Best stocks 2016

Hottest small cap stocks

Best stock picks

Who to follow for stock picks

Apple news stock picks

Stock picks on apple news