See feature articles below:

About Broad Street Alerts:

Big opportunities in Small Cap’s

Broad Street Alerts recent profiles and track record, 153% in verifiable potential gains for our members on the last 3 small cap alerts alone!

February 10th, 2016- (NASDAQ: BONT) opened $1.65/share hit a high of $3.00/share within 30 days our member potential gains- 83%

March 7th, 2016-(NYSE-MKT: FSI) opened at .91/share and hit 1.10/share within 5 days for gains of 21% for our members.

March 24th, 2016- (NASDAQ: ICLD) opened at $.77/share it a high of $1.15/share within 2 days for gains of 49% for our members.

These are numbers that make traders drool. Any trader in any market would fall all over themselves to see numbers like this. So if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP SMS/text alert service for free, simply text the word “Alerts” to the phone number 25827 from your cell phone.

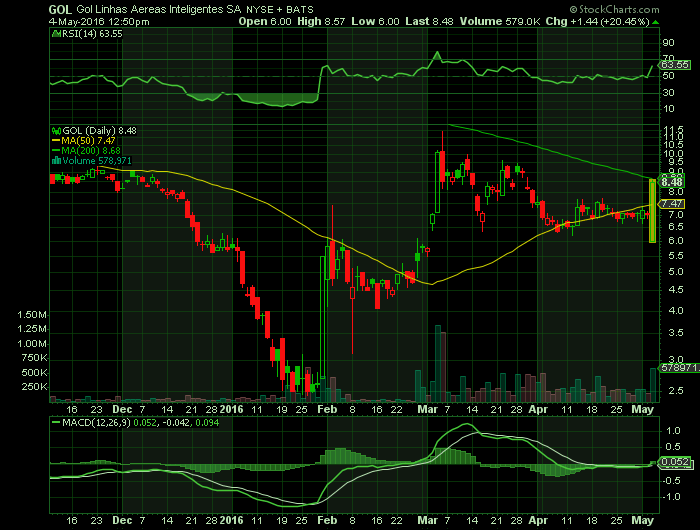

Report for: GOL

SAO PAULO, May 4 (Reuters) – Shares in Gol Linhas Aéreas Inteligentes SA posted their biggest intraday gain in over five weeks on Wednesday, a day after Brazil’s most indebted airline proposed investors to take losses of up to 70 percent on $780 million of outstanding bonds.

Nonvoting shares of Gol, which has Delta Air Lines Inc among shareholders, jumped as much as 15.4 percent to 2.92 reais in early Wednesday trading. The stock is down 67 percent in the past 12 months but recently gained on speculation of a debt restructuring plan.

Late on Tuesday, São Paulo-based Gol announced a plan to exchange outstanding bonds for new debt valid through June 1. Under terms of the plan, investors in Gol’s perpetual bond would assume a 70 percent loss, while those holding notes due in 2020, 2022 and 2023 would have to take on a so-called haircut of 65 percent.

The loss proposed for bondholders of the 2017 notes was put at 30 percent. The plan, which calls for the postponement of almost all debt repayments scheduled for this and next year and additional funding worth 300 million reais ($85 million), could help Gol stretch out maturities while reducing the burden of onerous debt-servicing.

According to Rogerio Araújo, an analyst with UBS Securities, Gol’s decision was “a great first step, but not enough if operations do not stop burning cash.”

Gol is the latest Brazilian company to negotiate a debt restructuring with creditors as Brazil’s harshest recession in decades, rising borrowing costs and accelerating inflation hamper the airline’s ability to repay liabilities.

Gol’s outstanding liabilities, including aircraft leases, reached 17 billion reais as of December.

($1 = 3.5423 Brazilian reais)

Source – Reuters by Tatiana Bautzer and Guillermo Parra-Bernal

Broad street alerts has not been compensated for the mention of any publicly traded companies in this article nor do we own positions in any of the companies in this article.

Stock market

Hot small cap stocks

small cap stock picks

Biotech stocks

FDA approval stocks

FDA calendar

Trade stocks

Become a day trader

Day trade stocks for a living

PDUFA date set

micro cap stocks

Best stocks 2016

Hottest small cap stocks

Best stock picks

Who to follow for stock picks

Apple news stock picks

Stock picks on apple news