See feature articles below:

About Broad Street Alerts:

Big opportunities in Small Cap’s

Broad Street Alerts recent profiles and track record, 153% in verifiable potential gains for our members on the last 3 small cap alerts alone!

February 10th, 2016- (NASDAQ: BONT) opened $1.65/share hit a high of $3.00/share within 30 days our member potential gains- 83%

March 7th, 2016-(NYSE-MKT: FSI) opened at .91/share and hit 1.10/share within 5 days for gains of 21% for our members.

March 24th, 2016- (NASDAQ: ICLD) opened at $.77/share it a high of $1.15/share within 2 days for gains of 49% for our members.

These are numbers that make traders drool. Any trader in any market would fall all over themselves to see numbers like this. So if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP SMS/text alert service for free, simply text the word “Alerts” to the phone number 25827 from your cell phone.

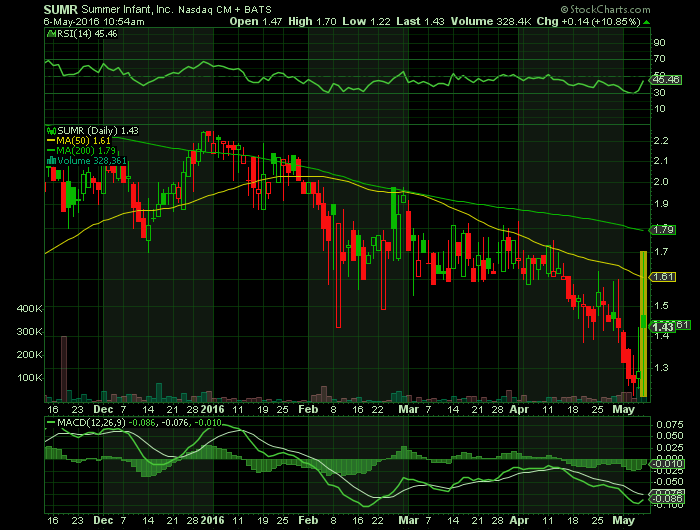

Report for: SUMR

WOONSOCKET, R.I., May 05, 2016 (GLOBE NEWSWIRE) — Summer Infant, Inc. (“Summer Infant” or the “Company”) (SUMR), a global leader in premium infant and juvenile products, today announced financial results for the fiscal first quarter ended April 2, 2016.

“The first quarter of 2016 was an active one for us, as we introduced a number of new products and took further measures to strengthen our balance sheet and streamline the Company’s operations,” said Bob Stebenne, Chief Executive Officer. “While revenue was down year-over-year, reflecting the timing of product rollouts, we continued our marketing initiatives while reducing debt, managing costs, and improving gross margins net of foreign exchange and demurrage expenses. We saw our G&A decline nearly 9% versus 2015, net of litigation expenses, evidence of our ongoing focus on cost-controls, while generating $6 million of operating cash flow. We believe the coming quarters will benefit from additional new product introductions – leading to higher top-line growth and overall improved operating results.”

First Quarter Results

Net sales for the three months ended April 2, 2016 were $49.7 million compared with $53.0 million for the three months ended April 4, 2015. Excluding $0.5 million of unfavorable foreign exchange on a constant currency basis, core branded sales declined by 5.3% year-over-year. The decrease was primarily due to channel inventory reductions in advance of new product launches as well as delays in certain product introductions.

Gross profit for the first quarter of 2016 was $15.7 million compared with $17.0 million for the first quarter of 2015, and gross margin was 31.7% in fiscal 2016 versus 32.0% in the prior year. The decline in gross profit margin was primarily due to $0.2 million of unfavorable foreign exchange on a constant currency basis and $0.3 million in temporary demurrage. Excluding the impact of the aforementioned charges, gross margin would have been 32.6% for the first quarter of 2016.

Selling expenses were $3.9 million in the first quarter of 2016 compared with $4.9 million in the first quarter of 2015; general and administrative expenses (G&A) were $10.8 million in fiscal 2016 versus $10.3 million in fiscal 2015. The fiscal first quarter of 2016 included $1.4 million of legal expenses in connection with ongoing litigation. Excluding litigation costs, G&A in the first quarter of fiscal 2016 would have been $9.4 million, down 8.9% from the prior-year period. The lower G&A reflects recent cost-reduction initiatives, and the Company is on track to achieve $4.0 million in annualized savings this year.

Interest expense decreased to $0.6 million in the first quarter of 2016 from $0.8 million last year, reflecting reduced debt levels and lower interest rates on the Company’s credit facility.

The Company reported a net loss of $0.3 million, or $(0.02) per share, in the first quarter of 2016 compared with a net loss of $0.2 million, or $(0.01) per share, in the first quarter of 2015. Adjusted EBITDA for the first quarter of 2016 rose 20%, to $3.1 million, versus $2.6 million for the first quarter of 2015. Adjusted EBITDA for the first quarter of 2016 includes $1.9 million in bank permitted add-back charges (primarily legal fees related to the ongoing litigation) compared with $0.6 million in the first quarter of 2015.

Adjusted EBITDA and constant currency adjustments are non-GAAP metrics. Adjusted EBITDA excludes various items that are detailed in the financial tables and accompanying footnotes reconciling GAAP to non-GAAP results contained in this release. An explanation of these measures also is included under the heading below “Use of Non-GAAP Financial Information.”

Balance Sheet Highlights

As of April 2, 2016, Summer Infant had approximately $0.4 million of cash and $47.4 million of debt compared with $0.9 million of cash and $53.6 million of debt on January 2, 2016; given the 12% debt reduction, the Company’s bank leverage ratio was 4.6 times the trailing twelve months’ Adjusted EBITDA at quarter end. Inventory as of April 2, 2016 was $37.6 million compared with $36.8 million as of January 2, 2016.

Trade receivables at the end of the first quarter were $36.5 million compared with $40.5 million as of January 2, 2016. Accounts payable and accrued expenses were $41.1 million as of April 2, 2016 compared with $39.1 million at the beginning of the fiscal year.

Conference Call Information

Management will host a conference call to discuss the financial results tomorrow, May 6, at 9:00 a.m. ET. To listen to the live call, visit the Investor Relations section of the Company’s website at www.summerinfant.com or dial 866-652-5200 or 412-317-6060. An archive of the webcast will be available on the Company’s website.

About Summer Infant, Inc.

Based in Woonsocket, Rhode Island, the Company is a global leader of premium infant and juvenile products for ages 0-3 years which are sold principally to large North American and international retailers. The Company currently sells proprietary products in a number of different categories including nursery audio/video monitors, safety gates, durable bath products, bed rails, nursery products, strollers, booster and potty seats, swaddling blankets, bouncers, travel accessories, highchairs, swings, and infant feeding products. For more information about the Company, please visit www.summerinfant.com.

Source – Company Press Release

Broad street alerts has not been compensated for the mention of any publicly traded companies in this article nor do we own positions in any of the companies in this article.

Broad Street Alerts was previously compensated eighteen thousand five hundred dollars by star media llc for the mention of FNJN however, that contract has expired.

Stock market

Hot small cap stocks

small cap stock picks

Biotech stocks

FDA approval stocks

FDA calendar

Trade stocks

Become a day trader

Day trade stocks for a living

PDUFA date set

micro cap stocks

Best stocks 2016

Hottest small cap stocks

Best stock picks

Who to follow for stock picks

Apple news stock picks

Stock picks on apple news