See feature articles below:

About Broad Street Alerts:

Big opportunities in Small Cap’s

Broad Street Alerts recent profiles and track record, 153% in verifiable potential gains for our members on the last 3 small cap alerts alone!

February 10th, 2016- (NASDAQ: BONT) opened $1.65/share hit a high of $3.00/share within 30 days our member potential gains- 83%

March 7th, 2016-(NYSE-MKT: FSI) opened at .91/share and hit 1.10/share within 5 days for gains of 21% for our members.

March 24th, 2016- (NASDAQ: ICLD) opened at $.77/share it a high of $1.15/share within 2 days for gains of 49% for our members.

These are numbers that make traders drool. Any trader in any market would fall all over themselves to see numbers like this. So if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP SMS/text alert service for free, simply text the word “Alerts” to the phone number 25827 from your cell phone.

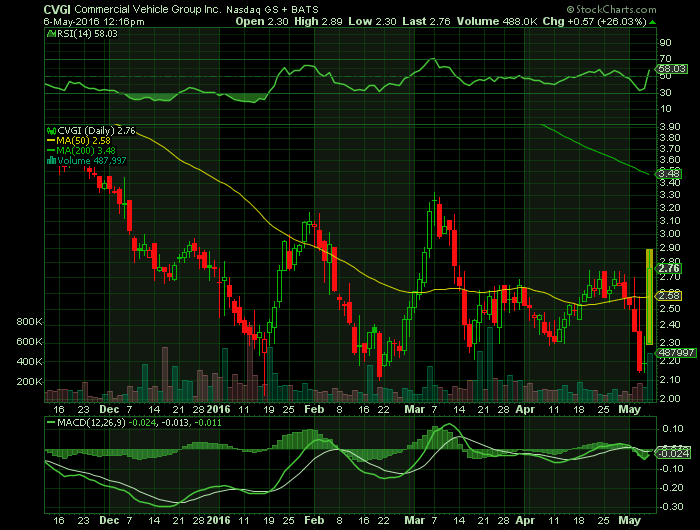

Report for: CVGI

Patrick Miller, President and CEO of Commercial Vehicle Group, stated, “Although we are facing challenging end markets in Global Construction and Agriculture, and more recently the retreat of North American heavy-duty truck build from an exceptionally high level in 2015, we are pleased with our results for the quarter. Our efforts to date in proactively reducing fixed costs has helped protect margins, align our cost structure, and improve capacity utilization to meet current and future market conditions. The recent announcement regarding our intent to consolidate our seat manufacturing capacity in North America is another step in our efforts to reduce fixed costs, while still providing adequate seat manufacturing capacity when production levels increase in the future. Additionally, we are staying focused on our growth actions in regards to new product development and the launch of our next generation products.”

Tim Trenary, Chief Financial Officer of Commercial Vehicle Group, stated, “Our gross profit margin for the quarter compared favorably to the prior-year period increasing by about 100 basis points due to ongoing efforts through our operational excellence, restructuring and other cost containment initiatives. SG&A for the first quarter, before giving effect to the $0.6 million write down of impaired assets, was approximately $1.5 million less than the prior year – that’s approximately an 8 percent reduction, period-over-period.”

Consolidated Results

First quarter 2016 revenues were $180.3 million compared to $220.3 million in the prior-year period, a decrease of 18.2 percent. The decrease in revenues period-over-period is driven primarily by the retreat of North American heavy-duty truck production volumes from near historically high levels in 2015 to more normalized levels in 2016, and the continued downturn in the global construction and agriculture markets we serve. Foreign currency translation adversely impacted first quarter revenues by $1.9 million, or 0.9 percent.

Operating income in the first quarter was $8.6 million compared to operating income of $11.2 million in the prior-year period. The decrease in operating income period-over-period was primarily the result of decreased revenues, offset by operational improvements and benefits from cost reduction and restructuring actions. First quarter 2016 results include $0.6 million of costs associated with the write-down of assets held for sale and $0.3 million of costs associated with recently announced restructuring plans. First quarter 2015 results include $0.7 million of costs associated with the closure of our Tigard, Oregon facility.

Net income was $2.6 million in the first quarter, or $0.09 per diluted share, compared to net income of $3.6 million, or $0.12 per diluted share, in the prior-year period. Earnings per share, as adjusted for special items, were $0.10 per diluted share in first quarter 2016, compared to $0.13 per diluted share in the prior-year period. Net income in the first quarter of 2016 benefited from a lower effective tax rate period-over-period.

For the period ending March 31, 2016, the Company did not have any borrowings under its asset-based revolver and therefore was not subject to any financial maintenance covenants. At March 31, 2016, the Company had liquidity of $135.3 million; $97.8 million of cash and $37.5 million of availability from our asset based revolver.

Segment Results

Global Truck and Bus Segment

Revenues for the Global Truck and Bus Segment for the first quarter of 2016 were $116.5 million compared to $145.9 million for the prior-year period, a decrease of 20.2 percent primarily resulting from the return of North American heavy-duty truck production to more normalized levels following near historically high production in 2015. Foreign currency translation adversely impacted first quarter revenues by $0.3 million, or 0.2 percent.

Operating income for the first quarter was $11.0 million compared to operating income of $14.1 million for the prior-year period. The decrease in operating income period-over-period is primarily the result of the decrease in revenues offset by operational improvements and the benefit of the cost reduction and restructuring actions. First quarter 2016 results include $0.1 million of costs associated with restructuring actions. First quarter 2015 results include $0.7 million of costs associated with the closure of our Tigard, Oregon facility.

Global Construction and Agriculture Segment

Revenues for the Global Construction and Agriculture Segment for the first quarter of 2016 were $65.8 million compared to $78.0 million in the prior-year period, a decrease of 15.7 percent. The global construction and agriculture end markets for which we manufacture products were down in the first quarter of 2016 as compared to the prior-year period. Foreign currency translation adversely impacted first quarter revenues by $1.7 million, or 2.2 percent.

Operating income for the first quarter was $3.8 million compared to operating income of $3.6 million for the prior-year period. The flat operating income period-over-period, notwithstanding the decline in sales, resulted from gross profit margin improvement, and reduced SG&A. First quarter 2016 results include $0.1 million of costs associated with restructuring actions.

GAAP to Non-GAAP Reconciliation

A reconciliation of GAAP to non-GAAP financial measures is included as Appendix A to this release.

2016 End Market Outlook

Management estimates that the 2016 North American Class 8 truck production will be in the range of 230,000 – 250,000 units, normalizing from a near historically high level of 323,000 units in 2015, while North American Class 5-7 will be stable to slightly up year-over-year. In 2016, management believes there is a bias toward continuing softness in the global construction and agriculture markets.

Source – Company Press Release

Broad street alerts has not been compensated for the mention of any publicly traded companies in this article nor do we own positions in any of the companies in this article.

Broad Street Alerts was previously compensated eighteen thousand five hundred dollars by star media llc for the mention of FNJN however, that contract has expired.

Stock market

Hot small cap stocks

small cap stock picks

Biotech stocks

FDA approval stocks

FDA calendar

Trade stocks

Become a day trader

Day trade stocks for a living

PDUFA date set

micro cap stocks

Best stocks 2016

Hottest small cap stocks

Best stock picks

Who to follow for stock picks

Apple news stock picks

Stock picks on apple news