See feature articles below:

About Broad Street Alerts:

Big opportunities in Small Cap’s

Broad Street Alerts recent profiles and track record, 153% in verifiable potential gains for our members on the last 3 small cap alerts alone!

February 10th, 2016- (NASDAQ: BONT) opened $1.65/share hit a high of $3.00/share within 30 days our member potential gains- 83%

March 7th, 2016-(NYSE-MKT: FSI) opened at .91/share and hit 1.10/share within 5 days for gains of 21% for our members.

March 24th, 2016- (NASDAQ: ICLD) opened at $.77/share it a high of $1.15/share within 2 days for gains of 49% for our members.

These are numbers that make traders drool. Any trader in any market would fall all over themselves to see numbers like this. So if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP SMS/text alert service for free, simply text the word “Alerts” to the phone number 25827 from your cell phone.

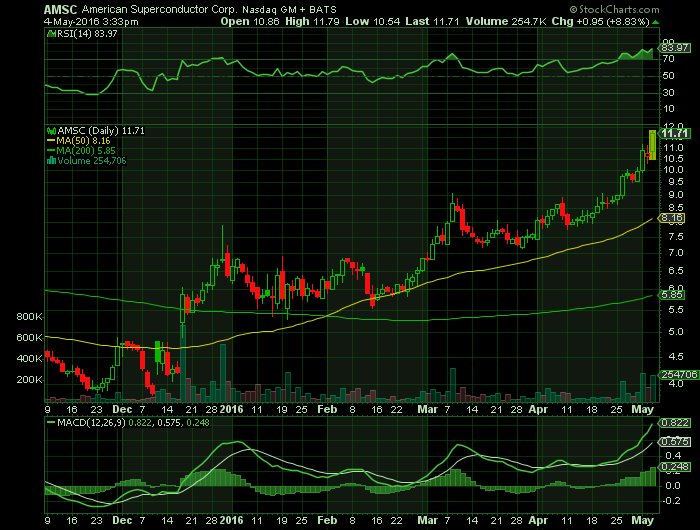

Report for: AMSC

American Superconductor Co. (NASDAQ:AMSC) was upgraded by Zacks Investment Research from a “hold” rating to a “buy” rating in a research note issued to investors on Monday, Market Beat reports. The brokerage currently has a $9.00 target price on the stock. Zacks Investment Research‘s price target would indicate a potential upside of 9.49% from the company’s previous close.

According to Zacks, “American Superconductor Corporation is a leading energy technologies company. The company develops and sells a wide range of products and solutions based on power electronic systems and high temperature superconductor wires that dramatically improve the efficiency, reliability and quality of electricity during its generation, transmission, distribution and use. The company is a dominant force in alternative energy, offering grid interconnection solutions as well as licensed wind energy designs and electrical systems. As the world’s principal supplier of HTS wire, AMSC is enabling a new generation of compact, high-power electrical products, including power cables, grid-level surge protectors, motors, generators, and advanced transportation and defense systems. AMSC also provides utility and industrial customers worldwide with voltage regulation systems that dramatically enhance power grid capacity, reliability and security, as well as industrial productivity. “

A hedge fund recently bought a new stake in American Superconductor stock. Creative Planning bought a new stake in shares of American Superconductor Co. (NASDAQ:AMSC) during the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm bought 10 shares of the company’s stock, valued at approximately $0.

Several other analysts have also issued reports on the stock. Rodman & Renshaw restated a “neutral” rating on shares of American Superconductor in a research report on Friday, April 1st. Ascendiant Capital Markets upgraded shares of American Superconductor from a “hold” rating to a “buy” rating in a research note on Thursday, December 17th. Finally, HC Wainwright reissued a “buy” rating and set a $10.00 target price on shares of American Superconductor in a research report on Wednesday, January 13th. One research analyst has rated the stock with a hold rating and four have given a buy rating to the stock. American Superconductor currently has a consensus rating of “Buy” and an average target price of $9.67.

American Superconductor Corporation (NASDAQ:AMSC) is a provider of megawatt-scale solutions. The Company conducts its business through two segments: Wind and Grid. Through its Windtec Solutions brand, the Wind business segment enables manufacturers to field wind turbines.

Source – South Florida Hedge Fund Managers

Broad street alerts has not been compensated for the mention of any publicly traded companies in this article nor do we own positions in any of the companies in this article.

Stock market

Hot small cap stocks

small cap stock picks

Biotech stocks

FDA approval stocks

FDA calendar

Trade stocks

Become a day trader

Day trade stocks for a living

PDUFA date set

micro cap stocks

Best stocks 2016

Hottest small cap stocks

Best stock picks

Who to follow for stock picks

Apple news stock picks

Stock picks on apple news