See feature articles below:

About Broad Street Alerts:

Big opportunities in Small Cap’s

Broad Street Alerts recent profiles and track record, 153% in verifiable potential gains for our members on the last 3 small cap alerts alone!

February 10th, 2016- (NASDAQ: BONT) opened $1.65/share hit a high of $3.00/share within 30 days our member potential gains- 83%

March 7th, 2016-(NYSE-MKT: FSI) opened at .91/share and hit 1.10/share within 5 days for gains of 21% for our members.

March 24th, 2016- (NASDAQ: ICLD) opened at $.77/share it a high of $1.15/share within 2 days for gains of 49% for our members.

These are numbers that make traders drool. Any trader in any market would fall all over themselves to see numbers like this. So if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP SMS/text alert service for free, simply text the word “Alerts” to the phone number 25827 from your cell phone.

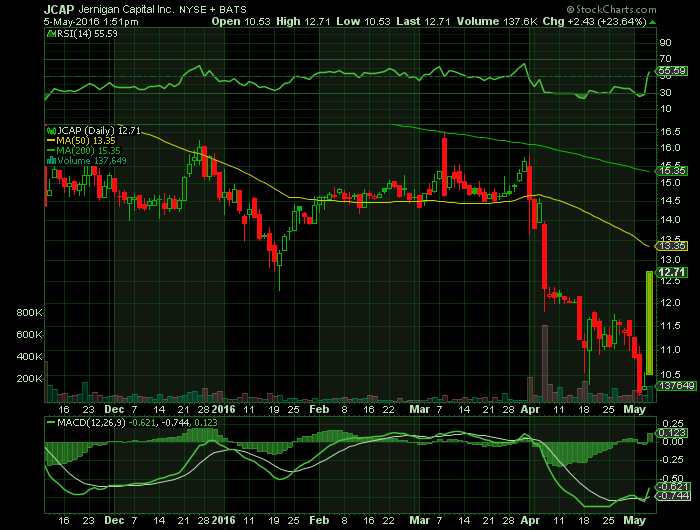

Report for: JCAP

Jernigan Capital, Inc. (JCAP) today announced results for the quarter ended March 31, 2016, reported on recent capital activities and updated annual earnings guidance, while issuing earnings guidance for the second quarter. Highlights include:

$0.53 adjusted earnings per share and $0.18 earnings per share (including transaction-related costs of $2.0 million); book value of $16.30 per share at quarter end;

8.6% decrease in general and administrative expenses from fourth quarter 2015;

$115.0 million of new capital to fund existing and future commitments, including $110.0 million in an institutional joint venture and $5.0 million from subordinated participations, or “A Notes” sold to a Tennessee bank;

Increased annual guidance for change in fair value of investments by approximately 50.0% from $5.0 – $7.0 million to $7.5 – $10.0 million, provided updated annual earnings per share guidance of $0.59 – $1.14 per share and provided earnings per share guidance for the three months ending June 30, 2016 of $0.22 – $0.34 per share; and

Increased annual adjusted earnings per share guidance by an average of 34.0%, from $0.79 – $1.24 per share to $1.10 – $1.61 per share; issued adjusted earnings per share guidance of $0.29 – $0.40 per share for three months ending June 30, 2016.

“The first quarter was a transformational quarter for our company,” commented Dean Jernigan, Chairman and Chief Executive Officer of Jernigan Capital, Inc. “First and foremost, we witnessed our initial self-storage development investments approach certificate of occupancy stage at estimated fair values that significantly exceeded our initial expectations and guidance, allowing us to increase by approximately 50.0% our guidance of expected fair value increases. Our financial results clearly demonstrate our ability to create shareholder value by focusing on well-located self-storage development projects during this unprecedented period of success for the self-storage sector.”

Mr. Jernigan continued: “In addition, since the beginning of the year we have accomplished important capital initiatives, including the previously announced institutional joint venture, the completion of our first two subordinated participation, or “A note,” sales and the procurement of a term sheet for a third A note sale, all at prices and rates similar to those we contemplated at the time of our initial public offering last year. These transactions have provided us with reasonably priced capital to fund our continued growth, and we expect to successfully continue pursuing these transactions. We are thrilled with the accomplishments of our excellent team over the past few months and are seeing a wonderful return on the investment in infrastructure that we have made.”

Financial Highlights

At March 31, 2016, after declaration of a quarterly dividend of $0.35 per share on the Company’s common stock, the Company’s book value per share was $16.30 per share compared to $16.44 per share as of December 31, 2015. As of March 31, 2016, the Company had total assets of $106.5 million, including $28.8 million of cash, total investments of $75.3 million, and total equity of $101.1 million. The Company had no debt at March 31, 2016. In addition, as of March 31, 2016 the Company held a $7.9 million interest in Storage Lenders LLC (the “SL1 Venture”), the Company’s joint venture with an affiliate of Heitman Capital Management and a large institutional co-investor.

Net income for the first quarter was $1.1 million, or $0.18 per share, and adjusted earnings for the quarter were $3.2 million, or $0.53 per share, an increase of $2.0 million and $3.9 million, respectively, over the net loss and adjusted loss for the fourth quarter of 2015.

The Company had interest income of approximately $1.1 million for the quarter ended March 31, 2016, an increase of approximately $0.1 million, or 13.4% over interest income for the quarter ended December 31, 2015.

General and administrative expenses for the quarter ended March 31, 2016 decreased approximately $162,000, or 8.6%, from the quarter ended December 31, 2015. General and administrative expenses for the quarters ended March 31, 2016 and December 31, 2015 were as follows:

Of the compensation and benefits expense for the three months ended March 31, 2016, approximately $175,000 consisted of stock-based compensation expense, which is a non-cash expense, compared to approximately $138,000 for the three months ended December 31, 2015.

Source – Company Press Release

Broad street alerts has not been compensated for the mention of any publicly traded companies in this article nor do we own positions in any of the companies in this article.

Stock market

Hot small cap stocks

small cap stock picks

Biotech stocks

FDA approval stocks

FDA calendar

Trade stocks

Become a day trader

Day trade stocks for a living

PDUFA date set

micro cap stocks

Best stocks 2016

Hottest small cap stocks

Best stock picks

Who to follow for stock picks

Apple news stock picks

Stock picks on apple news