See feature articles below:

About Broad Street Alerts:

Big opportunities in Small Cap’s

Broad Street Alerts recent profiles and track record, 153% in verifiable potential gains for our members on the last 3 small cap alerts alone!

February 10th, 2016- (NASDAQ: BONT) opened $1.65/share hit a high of $3.00/share within 30 days our member potential gains- 83%

March 7th, 2016-(NYSE-MKT: FSI) opened at .91/share and hit 1.10/share within 5 days for gains of 21% for our members.

March 24th, 2016- (NASDAQ: ICLD) opened at $.77/share it a high of $1.15/share within 2 days for gains of 49% for our members.

These are numbers that make traders drool. Any trader in any market would fall all over themselves to see numbers like this. So if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP SMS/text alert service for free, simply text the word “Alerts” to the phone number 25827 from your cell phone.

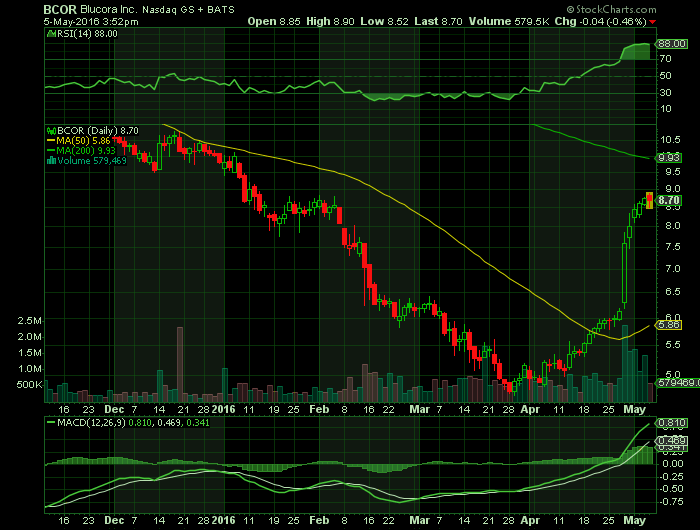

Report for: BCOR

Shares of Blucora (NASDAQ:BCOR) closed 24% higher on Thursday, driven by a strong first-quarter report. The maker of software tools for wealth management and tax preparation beat analyst targets on both the top and bottom lines, reflecting a respectable tax season.

Blucora’s first-quarter sales fell 5.1% year over year, to $165.8 million, but still came in ahead of Wall Street’s $163.1 million. Adjusted earnings of $0.94 per share represented a 6% increase over the year-ago period, and was $0.04 better than the Street’s consensus estimate.

Looking ahead, Blucora’s management expects second-quarter revenues of roughly $122 million, yielding adjusted earnings from continuing operations near $0.51 per diluted share. Here, analysts currently expect earnings of $0.58 per share on sales in the $117 million range.

Now what: Blucora shares have now gained more than 55% from recent multi-year lows. On the other hand, shares are trading down by 22% year to date, sliding 45% lower during the last 52 weeks, and a heart-stopping 80% below the highs seen in late 2013.

This is not a rousing victory. I’d call it a solid bounce off of recent lows, but all is certainly not well behind the curtain. And the company basically jumped over a very low bar. Analyst expectations were always disastrous.

Blucora’s TaxAct software handled 9% fewer returns this tax season compared to the 2015 season. Thanks to price increases, that still worked out to a 1% revenue increase; but it’s not a sign of a product-winning market share on its own merits. The clients here are mostly consumers, and that’s a price-sensitive crowd.

Although we don’t believe in timing the market or panicking over market movements, we do like to keep an eye on big changes — just in case they’re material to our investing thesis.

Blucora is busy doubling down on what it does well, and selling off non-core operations. Debt repayment is another important focus, because Blucora is laboring under a $571 million total debt load. The debt-to-equity ratio is through the roof, and revenues are shrinking.

Due to this mountain of financial risk, Blucora shares can be bought at a big discount. The stock is trading at roughly half of Blucora’s book value, meaning that investors think they’d be much better off if the company simply liquidated and returned the resulting cash to shareholders.

Source: Motley Fool

Broad street alerts has not been compensated for the mention of any publicly traded companies in this article nor do we own positions in any of the companies in this article.

Stock market

Hot small cap stocks

small cap stock picks

Biotech stocks

FDA approval stocks

FDA calendar

Trade stocks

Become a day trader

Day trade stocks for a living

PDUFA date set

micro cap stocks

Best stocks 2016

Hottest small cap stocks

Best stock picks

Who to follow for stock picks

Apple news stock picks

Stock picks on apple news