See feature articles below: (Nasdaq: TTNP)

About Broad Street Alerts:

Big opportunities in Small Cap’s

Broad Street Alerts recent profiles and track record, 217% in verifiable potential gains for our members on the last 4 small cap alerts alone!

February 10th, 2016- (NASDAQ: BONT) opened $1.65/share hit a high of $3.00/share within 30 days our member potential gains- 83%

March 7th, 2016-(NYSE-MKT: FSI) opened at .91/share and hit 1.10/share within 5 days for gains of 21% for our members.

March 24th, 2016- (NASDAQ: ICLD) opened at $.77/share it a high of $1.15/share within 2 days for gains of 49% for our members.

These are numbers that make traders drool. Any trader in any market would fall all over themselves to see numbers like this. So if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP SMS/text alert service for free, simply text the word “Alerts” to the phone number 25827 from your cell phone.

Report on : (Nasdaq: TTNP, EMMS, MBWM)(NYSE: UWM, NYCB)

Titan Pharmaceuticals Inc. (NASDAQ:TTNP) announced that it will host a live conference call at 4:15 p.m. EDT / 1:15 p.m. PDT on Tuesday, May 10, 2016 to discuss the company’s financial results as of March 31, 2016. The call will be hosted by Sunil Bhonsle, president and CEO; Kate Beebe, Ph.D., executive vice president and chief development officer; Brian Crowley, vice president of finance; and Marc Rubin, M.D., executive chairman. Highlights of the first quarter will be included in a press release to be issued prior to the call.

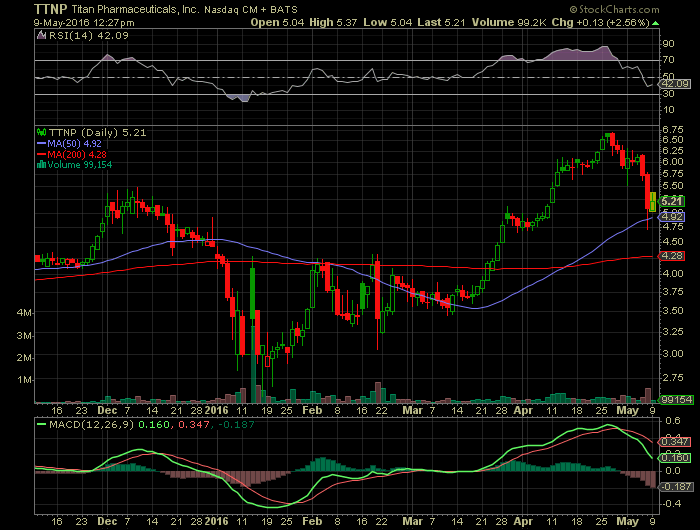

On Friday Titan Pharmaceuticals Inc. (NASDAQ:TTNP) share price closed at $5.08. Company return on equity (ROE) is -204.30%. Titan Pharmaceuticals Inc. (NASDAQ:TTNP) is -10.31% away from its 52 week high and its 52 week range is $2.57 – 10.00.

Emmis Communications Corp. (NASDAQ:EMMS) announced results for its fourth fiscal quarter and full-year ending February 29, 2016. Emmis’ radio net revenues for the fourth fiscal quarter were $36.4 million, down from $38.8 million from the prior year, a decrease of 6%. Per Miller Kaplan reporting, which excludes barter revenues and syndication revenues, and excluding LMA fee revenue in New York, Emmis’ fourth quarter radio revenues were down 7.3% compared to local radio market revenues up 0.7%. For the full year, radio revenues were $169.2 million, compared to $176.3 million in the prior year, a decrease of 4%.

Emmis Communications Corp. (NASDAQ:EMMS) traded 154915 shares and its share price moved down -3.70% to close at $0.52. Company has 10.20% insider ownership. Emmis Communications Corp. (NASDAQ:EMMS) quarterly performance is 13.04% while its year to date (YTD) performance is -18.75%.

Shareholders of New York Community Bancorp Inc. (NYSE:NYCB) and Astoria Financial Corporation (NYSE: AF) approved the proposed merger of the two companies. Pending regulatory approval, and subject to the terms of the Agreement and Plan of Merger dated as of October 28, 2015, Astoria Financial will merge with and into New York Community, and Astoria Bank will merge with and into New York Community Bank.

On Friday shares of New York Community Bancorp Inc. (NYSE:NYCB) ended up at $14.58. This year Company’s Earnings per Share (EPS) growth is -110.30% and next year’s EPS growth is 15.48%. Beta of New York Community Bancorp Inc. (NYSE:NYCB) is 0.82 while company weekly performance is -1.86%.

Nevada Gold & Casinos Inc. (NYSEMKT:UWN) announced the execution of an Agreement to sell approximately 260 acres of land in Gilpin County, Colorado to RSM Partners, LLC, a privately owned company, for $750,000. Pursuant to the Agreement, the Company received a $75,000 down payment and will finance the $675,000 balance at 5% interest only, payable monthly, with a balloon payment of $675,000 due April 30, 2019. The Company expects to record a non-cash impairment loss of approximately $350,000 in the fourth quarter of the 2016 fiscal year.

Nevada Gold & Casinos Inc. (NYSEMKT:UWN) advanced 0.50% to close at $2.03 on 06 May. Its return on assets (ROA) is 4.50% while return on investment (ROI) is 6.40%. Nevada Gold & Casinos Inc. (NYSEMKT:UWN) price to sales (P/S) ratio is 0.54.

Mercantile Bank Corp. (NASDAQ:MBWM) announced that on April 14, 2016, its Board of Directors declared a regular quarterly cash dividend of $0.16 per common share, payable June 23, 2016 to holders of record as of June 10, 2016. Mercantile also announced today that its Board of Directors has authorized a $15 million expansion of its existing common stock repurchase program. Since the implementation of its repurchase program in January of 2015, the Company has repurchased 936,197 shares of its common stock totaling approximately $19 million, or a weighted-average purchase price of $20.32 per share.

On 06 May Mercantile Bank Corp. (NASDAQ:MBWM) ended the day at $23.29. Company net profit margin stands at 24.10% whereas its return on equity (ROE) is 8.20%. Mercantile Bank Corp. (NASDAQ:MBWM) is -20.12% away from its 52 week high.

Source: KC Registry & ACAD Charts

Broad street alerts has not been compensated for the mention of any publicly traded companies in this article nor do we own positions in any of the companies in this article.