See feature articles below:

About Broad Street Alerts:

Big opportunities in Small Cap’s

Broad Street Alerts recent profiles and track record, 153% in verifiable potential gains for our members on the last 3 small cap alerts alone!

February 10th, 2016- (NASDAQ: BONT) opened $1.65/share hit a high of $3.00/share within 30 days our member potential gains- 83%

March 7th, 2016-(NYSE-MKT: FSI) opened at .91/share and hit 1.10/share within 5 days for gains of 21% for our members.

March 24th, 2016- (NASDAQ: ICLD) opened at $.77/share it a high of $1.15/share within 2 days for gains of 49% for our members.

These are numbers that make traders drool. Any trader in any market would fall all over themselves to see numbers like this. So if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP SMS/text alert service for free, simply text the word “Alerts” to the phone number 25827 from your cell phone.

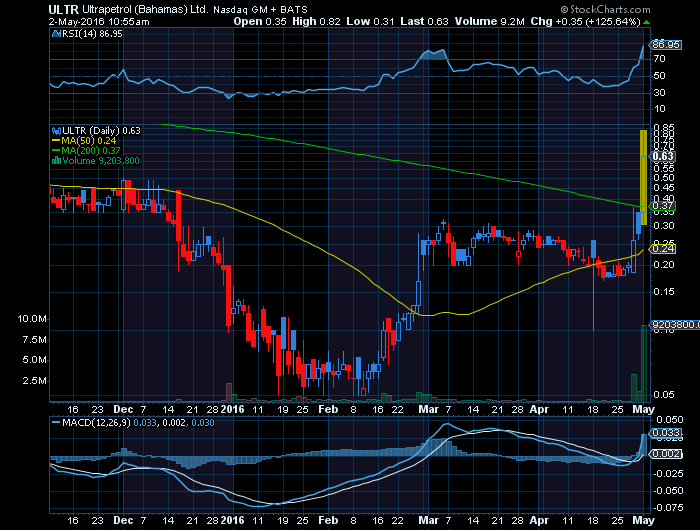

The following PR and supporting news may give insight into possible upside to (Nasdaq: ULTR) recent onslaught of troubles.

Latest PR- (NASDAQ: ULTR)

NASSAU, Bahamas, May 02, 2016 (GLOBE NEWSWIRE) — Ultrapetrol (Bahamas) Limited (ULTR) (“Ultrapetrol” or the “Company”) today that it is in on-going negotiations with its secured lenders to extend its existing forbearance agreements, which expired April 30, 2016, through May 31, 2016.

The Company is in continuing discussions with all of its secured creditors and expressed its confidence that a consensual financial restructuring can be achieved in order to provide Ultrapetrol with a sustainable capital structure that supports the Company’s long-term business plan and results in long-term value generation for the benefit of all stakeholders. During this period, the Company believes that it has sufficient liquidity to fully fund all aspects of its operations and to conduct business as usual, including making full and timely payments to employees, vendors, suppliers, and trading counterparties.

About Ultrapetrol

Ultrapetrol is an industrial transportation company serving the marine transportation needs of its clients in the markets on which it focuses. It serves the shipping markets for containers, grain and soy bean products, forest products, minerals, crude oil, petroleum, and refined petroleum products, as well as the offshore oil platform supply market with its extensive and diverse fleet of vessels. These include river barges and pushboats, platform supply vessels, tankers and two container feeder vessels. More information on Ultrapetrol can be found at www.ultrapetrol.net.

Forward-Looking Language

The forward-looking statements in this press release are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, our management’s examination of historical operating trends, data contained in our records and other data available from third parties. Although we believe that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond our control, we cannot assure you that we will achieve or accomplish these expectations, beliefs or projections.

In addition to these important factors, other important factors that, in our view, could cause actual results to differ materially from those discussed in the forward-looking statements include future operating or financial results; pending or recent acquisitions, business strategy and expected capital spending or operating expenses, including dry docking and insurance costs; general market conditions and trends, including charter rates, vessel values, and factors affecting vessel supply and demand; our ability to obtain additional financing; our financial condition and liquidity, including our ability to obtain financing in the future to fund capital expenditures, acquisitions and other general corporate activities; our expectations about the availability of vessels to purchase, the time that it may take to construct new vessels, or vessels’ useful lives; our dependence upon the abilities and efforts of our management team; changes in governmental rules and regulations or actions taken by regulatory authorities; adverse weather conditions that can affect production of the goods we transport and navigability of the river system; the highly competitive nature of the oceangoing transportation industry; the loss of one or more key customers; fluctuations in foreign exchange rates and devaluations; potential liability from future litigation; and other factors. Please see our filings with the Securities and Exchange Commission for a more complete discussion of these and other risks and uncertainties.

Ultra Petroleum files for Chapter 11-

Houston, Texas-based independent producer Ultra Petroleum and seven subsidiaries on Friday filed for protection from creditors under Chapter 11 of the U.S. Bankruptcy Code, the latest oil and gas company to succumb to the prolonged slump in energy prices.

Ultra listed $1.28 billion in assets and $3.92 billion in debt in court papers filed in Houston and reviewed by Kallanish Energy.

The producer’s primary assets are gas-producing properties in Wyoming, as well as some assets in Pennsylvania and crude oil properties in Utah, according to Bankruptcy Court papers.

“The low commodity prices, and especially the low natural gas prices that prevailed in 2015 and have continued through the first four months of 2016, have had a devastating impact,” Ultra Chief Financial Officer Garland Shaw said in a filing explaining events that led to the bankruptcy.

Court documents show five firms hold at least 5.2% of Ultra’s equity, including Disciplined Growth Investors (9.1% of company equity), Invesco (7.9%), Vanguard (6.7%), Blackrock (5.7%), and State Street (5.2%).

The largest unsecured investor, owed a disputed $1.46 billion is in the form of private placement notes issued by Ultra Resources in care of Morgan, Lewis & Bockius.

Between March and early April, Ultra missed a series of principal and interest payments owed to lenders and bondholders. And on April 14, the company was sued by pipeline operator Sempra Rockies Marketing for failing to pay transport fees.

The oil market is suffering its worst slump in decades, brought on by a glut of production. Much of the problem can be traced to a record-breaking surge in U.S. oil production that wouldn’t have been possible without a tremendous amount of debt.

Many independent drillers outspent cash flow even when oil was $100 a barrel, and made up the difference with bank loans and high-yield bonds. In the meantime, crude is hugging the $40/Bbl range.

Source: Globe Newswire, Kallanish Energy News, & ACAD Sharp Charts

Broad street alerts has not been compensated for the mention of any publicly traded companies in this article nor do we own positions in any of the companies in this article.

Hot small cap stocks

small cap stock picks

Biotech stocks

FDA approval stocks

FDA calendar

Trade stocks

Become a day trader

Day trade stocks for a living

PDUFA date set

micro cap stocks

Best stocks 2016

Hottest small cap stocks

Best stock picks

Who to follow for stock picks

Apple news stock picks

Stock picks on apple news