See feature articles below:

About Broad Street Alerts:

Big opportunities in Small Cap’s

Broad Street Alerts recent profiles and track record, 153% in verifiable potential gains for our members on the last 3 small cap alerts alone!

February 10th, 2016- (NASDAQ: BONT) opened $1.65/share hit a high of $3.00/share within 30 days our member potential gains- 83%

March 7th, 2016-(NYSE-MKT: FSI) opened at .91/share and hit 1.10/share within 5 days for gains of 21% for our members.

March 24th, 2016- (NASDAQ: ICLD) opened at $.77/share it a high of $1.15/share within 2 days for gains of 49% for our members.

These are numbers that make traders drool. Any trader in any market would fall all over themselves to see numbers like this. So if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP SMS/text alert service for free, simply text the word “Alerts” to the phone number 25827 from your cell phone.

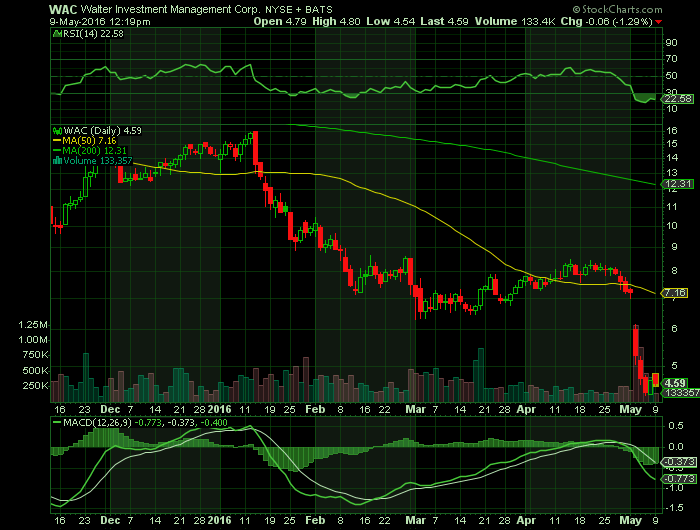

Article for: WAC

Thank you. Good morning, everyone. During the first quarter of 2016, we maintained our national ranking as a top 10 servicer, growing the service book of business with the addition of approximately $10 billion of sub servicing arrangements, MSR acquisitions, and originated MSR to $275.7 billion and assisting approximately 12,000 homeowners in attaining modifications of their loans.

We funded loans in our originations and reverse mortgage segments of $5.2 billion, including the origination of approximately 9,500 HARP loans for the quarter. The first quarter activity allowed us to maintain our ranking as a top 15 originator in the nation.

Our first quarter results were impacted by the significant drop in interest rates experienced in the first quarter. We saw the 10-year Treasury decline a total of 49 basis points, from 2.27% on December 31, 2015 and hitting a low of 1.63% during the quarter, before closing on March 31 at 1.78%.

Our assets and liabilities accounted for using fair value methodology incurred non-cash charges relating to changes in inputs and assumptions of approximately $140.5 million after taxes, contributing a loss of $3.95 on a per share basis to the quarter’s GAAP net loss of $4.85 per share. Results reported on an adjusted basis were impacted by the rate movement, as well as the adjusted loss of $17.8 million, or $0.50 per share after tax, reflected negative impacts related to accelerated prepayments and reductions in pipeline MSR values since the date of lock.

Adjusted EBITDA for the quarter was $87.1 million, $74.6 million of which was contributed by our servicing segment, $23.8 million from originations, and a negative adjusted EBITDA of $9.5 million in the reverse mortgage segment. Our reverse segment continues to be impacted by lower gain on sales revenues, as well as the continued elevation of expenses related to regulatory changes, including the issuance of the mortgagee letters beginning in April of 2015 which change the timing and scope of those properties being moved into a due and payable status. These changes, along with the maturing of the portfolio, resulted in the largest number of loans entering this process in the Company’s history during the first quarter of 2016.

Over the course of the quarter, we made progress on a number of important initiatives, including transitioning approximately 1.4 million customers to the industry-standard servicing platform MSP, which is expected to enhance operational efficiencies within our servicing business. We also completed the closure of our retail originations channel which, along with other reorganization activities are expected to result in annualized savings of approximately $28 million.

Finally, we have advanced our early-stage reengineering initiative which we launched in the first quarter, targeted at both providing an exceptional customer experience and cost and revenue efficiencies. We are very enthusiastic about the early results and expect the initial impact of our efforts to be reflected in the second half of 2016, with significant improvements to be realized in 2017.

While we are still early in the process, it is clear that the opportunity to drive dramatic change throughout the organization is substantial. Gary will provide some additional color on our expectations associated with this initiative later in the call.

On the environment, we continue to see an evolution of the operating environment within our sector. The economic outlook predicts moderate growth. Latest expectations published by Fannie Mae included approximately $1.6 trillion of origination volumes for 2016 and a continued low interest rate environment, which remains supportive of the refi loans. The offset is the increased levels of expected prepayments on the portfolio. We believe we will continue to see rate volatility, with the curve reflecting a bias toward higher levels over time, which would serve to improve MSR valuations.

Regulatory oversight of the sector remains high, impacting both the servicing and origination businesses. While the pace of change has moderated, the associated costs continue to be absorbed through the operations.

Against this backdrop, we would expect to see acceleration of consolidation amongst the market sub scale participants, as the environment has increased fixed costs for everyone and, in some cases, reduced revenue. Financial institutions continue to focus on their core clients, allowing non-bank participants to gain market share in both servicing and originations, driven by the non-core segment of the market.

As the operating environment for mortgage sector participants continues to evolve, Walter is undertaking a number of transformative actions aimed at driving long-term value for our shareholders. First is to deliver an exceptional customer experience. We are intently focused on pursuing our goal to become a lifelong partner in home ownership for our customers.

The best way to earn our customers’ loyalty is to consistently deliver exceptional service. Exceptional service begins and ends with exceptional employees. Walter has exceptional employees. We are focusing energy company-wide to elevate awareness around the shared values of our high performance culture, values that Walter employees themselves define. Living these shared values will strengthen our Company and should dramatically improve employee satisfaction and directly impact our customer experience in a positive way.

The second key to driving value relates to operational excellence. We are intensely focused on becoming better at what we do. We must be the most efficient operator in the business. As we discussed in our fourth quarter earnings call, we have undertaken a company-wide initiative to reengineer our business processes. Though we are in the early stages of the project, we believe the opportunity is large, reaches every corner of the organization.

Deploying technologies aimed at improving our efficiencies and enhancing our customers’ interactions with us will enable this effort. The transition of approximately 1.4 million customers to MSP was, again, an important step in our efforts to modernize our technology solution, increasing efficiencies and enhancing our ability to provide an exceptional customer experience.

Finally, the efficient allocation of our capital is key to driving value. Our focus is to deleverage our balance sheet so that we can compete from a position of financial strength. We have ongoing dialogue with WCO and other third parties to establish future flow transactions and opportunistic MSR sales generally on a sub service retained basis.

We are also pursuing outsourcing opportunities as an avenue to add business to the servicing portfolio in a capital efficient matter at attractive returns. Our success with these initiatives should free up capital to augment excess cash flow generated by operations and the proceeds from the planned sale of our insurance business, which we plan to utilize to help us meet our leverage reduction targets.

In the current environment, we see significant challenges for participants and barriers to entry to the sector. We believe Walter has the scale, track record, strong relationships and determination needed to meet the challenges and be successful in an evolving sector and we are moving aggressively to transform the organization to drive value for shareholders. With that, I will ask Gary to cover the financial and operational highlights for our business. Gary?

——————————————————————————–

Gary Tillett, Walter Investment Management Corporation – CFO [4]

——————————————————————————–

Thanks, Denmar. In the servicing segment, despite increase prepayments, our servicing UPB grew 4% to $255.3 billion, ranking us as a top 10 national servicer.

The service portfolio increased through $17.5 billion of additions, including approximately $10 billion of sub servicing UPB from our previously announced RCS transaction and approximately $3.6 billion UPB of distressed GSE mortgage loans. This increase was offset by higher than expected levels of prepayments, driven by the low interest rate environment.

The servicing business delivered $74.6 million of adjusted EBITDA and an adjusted EBITDA margin for the quarter of 12 basis points, in line with previously provided targets of 11 basis points to 15 basis points. Servicing’s adjusted loss for the quarter of $1.2 million reflects the impact of continued low interest rates. Included in adjusted earnings are fair value reductions of MSRs related to accelerated prepayments, as well as the effect of pipeline MSR declines since the date of lock.

During the quarter, we transitioned a significant portion of our servicing portfolio to the MSP platform. While provisions for excess costs related to this transfer were included in our operating plans, we incurred approximately $5 million above our expectations for the project, further impacting profitability. Given the low interest rate environment today, we believe the adjusted earnings margin for the servicing sector could be lower than our previously provided target, as we would expect to continue to see elevated levels of prepayments in the near term, particularly in the portfolio accounted for at fair value.

We continue to pursue outsourcing opportunities with our clients, as well as transactions with WCO and other potential counter parties, as we look to increase the mix of sub servicing business in our portfolio, adding product to the platform in a capital efficient manner. Through our company-wide initiative to reengineer our processes, we are targeting improvement in core operations through the deployment of technology, with the recent transition of 1.4 million accounts to MSP serving to launch this component of the initiative. Our reengineering efforts are expected to drive continuous improvement of our cost structure and enhancement of revenue opportunities over time.

Let’s now turn to the originations segment, which maintained solid margin performance despite volume declines. Originations funded $5 billion of UPB in the current quarter, a decrease of 9% as compared to the prior-year quarter. However, the combined direct margin of 80 basis points for the current quarter increased 11 basis points over the prior-year quarter, driven by a shift in mix from the lower margin correspondent channel to the higher margin consumer channel.

The segment generated adjusted EBITDA of $23.8 million and adjusted earnings of $17.9 million for the quarter. The Q1 recapture rate increased sequentially to 26% from 23% in the fourth quarter of 2015, as we remain focused on maximizing a retention opportunity resident in our portfolio of approximately 476,000 in the money accounts.

We have also increased our investment in building our consumer lending channel, including the addition of a new leader, and plans to expand our sales force with a goal of increasing our recapture rates and maximizing earnings in the continued low interest rate environment. However, as part of our capital management strategy, we have increased our return holders for MSRs acquired, which has negatively impacted volumes in the correspondent channel. As a result, correspondent channel volumes for 2016 may be negatively impacted.

As announced earlier this year, we exited the retail channel in January as part of our further reorganization efforts in Ditech. As a result, during the first quarter of this year, our indirect expenses in the origination segment decreased from prior year run rate, driven by reductions in support expenses related to this channel and increased cost efficiencies, representing a portion of the $28 million annualized savings expected to be achieved through the closure of the retail channel and our other reorganization activities undertaken in the first quarter.

As part of our efforts to improve the customer experience, we are working to deploy technology solutions, which include investing and digital technologies and point-of-sale services designed to improve our self-serve capabilities. We are piloting these technologies now and expect to roll them out more broadly during the third quarter.

The reverse segment experienced another challenging quarter, with results reflecting the impact of significantly reduced originations volumes and continued elevated expenses driven by increased defaulted mortgage activity resulting from 2015’s regulatory changes. Reverse’s negative adjusted EBITDA of $9.5 million and adjusted loss of $10.4 million for the first quarter of 2016 reflect the impact of lower gain on sale revenues attributable to lower volumes and a reduction in net servicing revenues and fees.

Despite these disappointing results, we believe in the value of the RMS franchise and are taking steps which we believe will drive meaningful improvement to the business. These steps include continuing to strengthen the management team, enhancing sales operations to drive increased consumer channel volumes, and maintaining a disciplined approach to our investments in the correspondent and wholesale channels.

In the default servicing area, we have made significant improvements that should result in materially reduced curtailment charges caused by defaults in the portfolio. Given the current market conditions and the segment’s first quarter losses, we anticipate achieving positive adjusted earnings for the year will be a challenge.

As Denmar mentioned, we currently have a high priority project underway to drive efficiencies across the organization and maintain discipline around capital allocation to improve the financial strength of our balance sheet. We have substantially negotiated the terms of an agreement to sell the insurance business and are awaiting regulatory input before finalizing the agreement.

As we have previously mentioned, our discussions with WCO and other potential counter parties related to future flow transactions and other select MSR sales are an important component of our strategy to enhance our balance sheet strength by reducing our investment in MSRs. To this end, during the quarter we entered into a binding letter of intent to sell $4.6 billion of UPB of GSE MSR to a third party with servicing release.

During the first quarter, we prepaid approximately $7.2 million par value debt for approximately $6.3 million and expect that we will utilize a combination of excess cash flows from operations, proceeds from the planned sale of our insurance business, and potential sales of MSR to further reduce our corporate debt in the future.

And lastly, as we indicated in February, we recently initiated a significant reengineering project designed to improve efficiency across the organization. Based on our preliminary review of certain areas of the Company, we have already identified opportunities for improvement in the $60 million to $75 million range. One-time costs to achieve these improvements are estimated in the $20 million to $25 million range.

Implementation of many of the actions related to this phase of the project is already in process and we expect to see a meaningful impact on results in the second half of 2016. Based on the findings of this preliminary analysis, we accelerated a more comprehensive review of the business, which includes expanding the scope of the project company-wide and going deeper into areas already reviewed. We expect to find additional significant opportunities as we move forward and plan to provide an update on the second quarter earnings call.

We are not satisfied with our recent performance and are fully focused on improvement in the future. I will now turn the call back to Denmar for a quick wrap-up review. Denmar?

——————————————————————————–

Denmar Dixon, Walter Investment Management Corporation – CEO [5]

——————————————————————————–

Thank you, Gary. I will be brief. The summary for the key takeaways for the business are as follows. We see a market opportunity set that we believe we can successfully deploy the strengths of our platform against. We see three keys necessary to drive shareholder value, a great customer experience, best-in-class operational efficiency, and intelligent capital allocation.

We plan to meaningfully improve customer experience by first focusing on our own employees and our cultural values. On an operating basis, we are identifying significant opportunities to reduce cash costs, drive revenue and create efficiency gains across the platform for a redesign of our processes and the deployment of technology solutions. In addition to our operational transformation, we will focus on our balance sheet-related actions. We’re targeting a significant reduction in leverage and pursuing several transactions to add to service UPB in a capital efficient manner.

Source – Reuters

Broad street alerts has not been compensated for the mention of any publicly traded companies in this article nor do we own positions in any of the companies in this article.

Stock market

Hot small cap stocks

small cap stock picks

Biotech stocks

FDA approval stocks

FDA calendar

Trade stocks

Become a day trader

Day trade stocks for a living

PDUFA date set

micro cap stocks

Best stocks 2016

Hottest small cap stocks

Best stock picks

Who to follow for stock picks

Apple news stock picks

Stock picks on apple news